Definitions

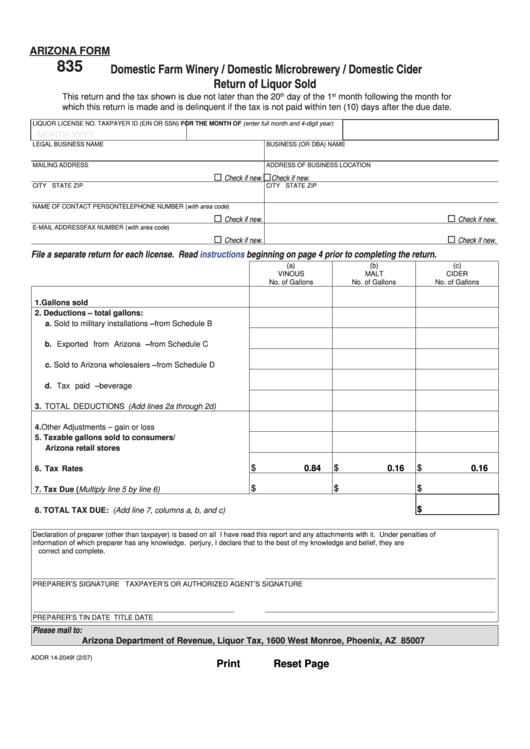

ARIZONA FORM

835

Domestic Farm Winery / Domestic Microbrewery / Domestic Cider

Return of Liquor Sold

This return and the tax shown is due not later than the 20

th

day of the 1

st

month following the month for

which this return is made and is delinquent if the tax is not paid within ten (10) days after the due date.

LIQUOR LICENSE NO.

TAXPAYER ID (EIN OR SSN)

FOR THE MONTH OF (enter full month and 4-digit year)

MONTH YYYY

LEGAL BUSINESS NAME

BUSINESS (OR DBA) NAME

MAILING ADDRESS

ADDRESS OF BUSINESS LOCATION

Check if new.

Check if new.

CITY

STATE

ZIP

CITY

STATE

ZIP

NAME OF CONTACT PERSON

TELEPHONE NUMBER (with area code)

Check if new.

Check if new.

E-MAIL ADDRESS

FAX NUMBER (with area code)

Check if new.

Check if new.

File a separate return for each license. Read

instructions

beginning on page 4 prior to completing the return.

(a)

(b)

(c)

VINOUS

MALT

CIDER

No. of Gallons

No. of Gallons

No. of Gallons

1. Gallons sold ......................................................................

2. Deductions – total gallons:

a. Sold to military installations – from Schedule B ...........

b. Exported from Arizona – from Schedule C ...................

c. Sold to Arizona wholesalers – from Schedule D ..........

d. Tax paid – beverage returned.......................................

3. TOTAL DEDUCTIONS (Add lines 2a through 2d) ...............

4. Other Adjustments – gain or loss ........................................

5. Taxable gallons sold to consumers/

Arizona retail stores .........................................................

$

0.84

$

0.16

$

0.16

6. Tax Rates ...........................................................................

$

$

$

7. Tax Due (Multiply line 5 by line 6) .......................................

$

8. TOTAL TAX DUE: (Add line 7, columns a, b, and c) ...................................................................................

Declaration of preparer (other than taxpayer) is based on all

I have read this report and any attachments with it. Under penalties of

information of which preparer has any knowledge.

perjury, I declare that to the best of my knowledge and belief, they are

correct and complete.

PREPARER’S SIGNATURE

TAXPAYER’S OR AUTHORIZED AGENT’S SIGNATURE

PREPARER’S TIN

DATE

TITLE

DATE

Please mail to:

Arizona Department of Revenue, Liquor Tax, 1600 West Monroe, Phoenix, AZ 85007

ADOR 14-2049f (2/07)

Print

Reset Page

1

1 2

2 3

3 4

4