Sales And Use Tax Regulations - California Board Of Equalization Page 3

ADVERTISEMENT

Regulation 1574 (Continued)

Proof: $10,000 – 233.66 = $9,766.34

$9,766.34 x 33% = $3,222.89

Gross receipts from the sale of cold food products, hot coffee, hot tea and hot chocolate subject to the tax may be

calculated for the year 1990 and forward using the following percentages for the tax rates indicated:

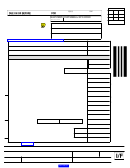

TAX RATE

PERCENTAGE

TAX RATE

PERCENTAGE

6.00%

32.3593%

7.50%

32.2030%

6.50%

32.3070%

7.625%

32.1900%

6.625%

32.2940%

7.75%

32.1771%

6.75%

32.2809%

7.875%

32.1641%

6.875%

32.2679%

8.00%

32.1512%

7.00%

32.2549%

8.125%

32.1383%

7.125%

32.2419%

8.25%

32.1254%

7.25%

32.2289%

8.375%

32.1125%

7.375%

32.2160%

8.50%

32.0996%

To compute the cold food factor for other tax rates the formula is as follows:

Cold food factor percentage = 100 ÷ [3.0303 + tax rate (decimal form)]

Example: Cold food factor at 7.25% = 100 ÷ (3.0303 +.0725) = 100 ÷ 3.1028 = 32.2289%

(D)

Tax does not apply to sales of any food products, whether sold through a vending machine or

otherwise, to students of a school by public or private schools, school districts, student organizations, or any blind

person (as defined in Section 19153 of the Welfare and Institutions Code) operating a restaurant or vending stand in

an educational institution under Article 5 (commencing with Section 19625) of Chapter 6 of Part 2 of Division 10 of the

Welfare and Institutions Code.

(3) DEFINITIONS

(A)

FOOD PRODUCTS.

For the period July 15, 1991 through November 30, 1992, the term "food

products" does not include snack foods (as defined in Regulation 1602 (18 CCR 1602), "Food Products"),

nonmedicated gum, candy, and confectionery. Sales during this period of such items through vending machines are

subject to the tax unless exempted under subdivisions (b)(1) and (b)(2) above.

(B)

NONPROFIT ORGANIZATIONS.

Nonprofit organizations include any group, association, or

corporation which is formed for charitable, religious, scientific, social, literary, educational, recreational, benevolent or

any other purpose, provided that no part of the net earnings of such organization inures to the benefit of any member,

shareholder, director, officer, or any person having a personal and private interest in the activities of the organization.

Examples of this type of organization are museums, veterans organizations, youth sportsmanship organizations,

clubs such as the Kiwanis Club, fraternal societies, orders or associations operating under the lodge system such as

the Loyal Order of the Moose, and student organizations.

(C)

CHARITABLE ORGANIZATIONS.

Charitable organizations include any group, association, or

corporation created for or devoted to charitable purposes, the net earnings of which are used solely for charitable

purposes such as the relief of poverty, advancement of education, the advancement of religion, the promotion of

health and the promotion of government. Examples of this type of organization are libraries, museums, hospitals,

senior citizen community centers, thrift shops, and organizations such as the Salvation Army and Goodwill.

(D)

EDUCATION ORGANIZATIONS.

Education organizations include any profit or nonprofit group,

association, or corporation which normally maintains a regular faculty and curriculum and normally has a regularly

enrolled body of pupils or students in attendance at the place where its education activities are regularly carried on.

Examples of such organizations are primary and secondary schools, colleges, professional and trade schools,

whether public, private, nonprofit or profit making.

(4) RESALE AND EXEMPTION CERTIFICATES.

(A)

VENDORS OF ITEMS FOR 15 CENTS OR LESS ONLY.

A purchaser who sells the property

purchased only through vending machines for 15 cents or less may give an exemption certificate with respect to the

purchase of nonreturnable containers, but may not give a resale certificate with respect to the purchase of any other

property. The supplier is responsible for payment of sales tax on the gross receipts from the sales to the purchaser of

property, the sale of which is subject to tax.

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5