S

N

J

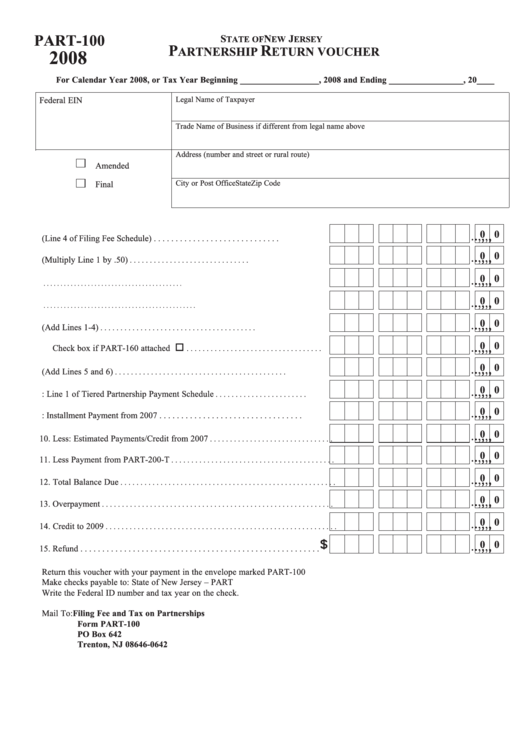

PART-100

TATE OF

EW

ERSEY

P

R

ARTNERSHIP

ETURN VOUCHER

2008

For Calendar Year 2008, or Tax Year Beginning __________________, 2008 and Ending _________________, 20____

Legal Name of Taxpayer

Federal EIN

Trade Name of Business if different from legal name above

Address (number and street or rural route)

Amended

City or Post Office

State

Zip Code

Final

, ,

, ,

. .

0 0

1. Filing Fee (Line 4 of Filing Fee Schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

2. Installment Payment (Multiply Line 1 by .50)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

3. Nonresident Noncorporate Partner Tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

4. Nonresident Corporate Partner Tax

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

5. Total Fee and Tax (Add Lines 1-4)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Penalty for Underpayment of Estimated Tax.

, ,

, ,

. .

0 0

Check box if PART-160 attached

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

7. Total Due (Add Lines 5 and 6)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

8. Less: Line 1 of Tiered Partnership Payment Schedule

. . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

9. Less: Installment Payment from 2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

10. Less: Estimated Payments/Credit from 2007

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

11. Less Payment from PART-200-T

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

12. Total Balance Due

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

13. Overpayment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

, ,

, ,

. .

0 0

14. Credit to 2009

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

, ,

, ,

. .

0 0

15. Refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Return this voucher with your payment in the envelope marked PART-100

Make checks payable to: State of New Jersey – PART

Write the Federal ID number and tax year on the check.

Mail To: Filing Fee and Tax on Partnerships

Form PART-100

PO Box 642

Trenton, NJ 08646-0642

1

1 2

2