Tax Treaty Representation Letter Form-University Of Maryland

ADVERTISEMENT

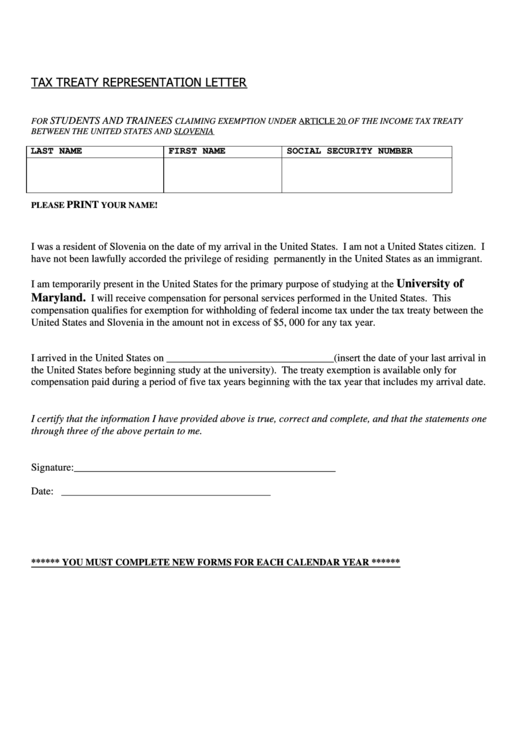

TAX TREATY REPRESENTATION LETTER

STUDENTS AND TRAINEES

FOR

CLAIMING EXEMPTION UNDER ARTICLE 20 OF THE INCOME TAX TREATY

BETWEEN THE UNITED STATES AND SLOVENIA

LAST NAME

FIRST NAME

SOCIAL SECURITY NUMBER

PRINT

PLEASE

YOUR NAME!

I was a resident of Slovenia on the date of my arrival in the United States. I am not a United States citizen. I

have not been lawfully accorded the privilege of residing permanently in the United States as an immigrant.

University of

I am temporarily present in the United States for the primary purpose of studying at the

Maryland.

I will receive compensation for personal services performed in the United States. This

compensation qualifies for exemption for withholding of federal income tax under the tax treaty between the

United States and Slovenia in the amount not in excess of $5, 000 for any tax year.

I arrived in the United States on ________________________________(insert the date of your last arrival in

the United States before beginning study at the university). The treaty exemption is available only for

compensation paid during a period of five tax years beginning with the tax year that includes my arrival date.

I certify that the information I have provided above is true, correct and complete, and that the statements one

through three of the above pertain to me.

Signature:__________________________________________________

Date: ________________________________________

****** YOU MUST COMPLETE NEW FORMS FOR EACH CALENDAR YEAR ******

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1