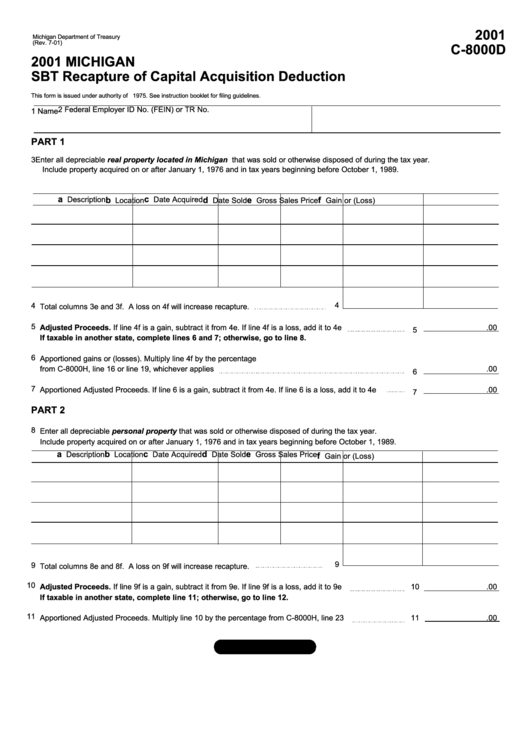

Form C-8000d - Michigan Sbt Recapture Of Capital Acquisition Deduction - 2001

ADVERTISEMENT

2001

Michigan Department of Treasury

(Rev. 7-01)

C-8000D

2001 MICHIGAN

SBT Recapture of Capital Acquisition Deduction

This form is issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

2 Federal Employer ID No. (FEIN) or TR No.

1 Name

PART 1

3 Enter all depreciable real property located in Michigan that was sold or otherwise disposed of during the tax year.

Include property acquired on or after January 1, 1976 and in tax years beginning before October 1, 1989.

a

c

Description

b

Date Acquired

d

e

f

Location

Date Sold

Gross Sales Price

Gain or (Loss)

4

4

Total columns 3e and 3f. A loss on 4f will increase recapture.

5

Adjusted Proceeds. If line 4f is a gain, subtract it from 4e. If line 4f is a loss, add it to 4e

.00

5

If taxable in another state, complete lines 6 and 7; otherwise, go to line 8.

6

Apportioned gains or (losses). Multiply line 4f by the percentage

from C-8000H, line 16 or line 19, whichever applies

.00

6

7

Apportioned Adjusted Proceeds. If line 6 is a gain, subtract it from 4e. If line 6 is a loss, add it to 4e

.00

7

PART 2

8

Enter all depreciable personal property that was sold or otherwise disposed of during the tax year.

Include property acquired on or after January 1, 1976 and in tax years beginning before October 1, 1989.

a

b

c

d

e

Description

Location

Date Acquired

Date Sold

Gross Sales Price

f

Gain or (Loss)

9

9

Total columns 8e and 8f. A loss on 9f will increase recapture.

10

Adjusted Proceeds. If line 9f is a gain, subtract it from 9e. If line 9f is a loss, add it to 9e

10

.00

If taxable in another state, complete line 11; otherwise, go to line 12.

11

Apportioned Adjusted Proceeds. Multiply line 10 by the percentage from C-8000H, line 23

11

.00

Continue on page 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2