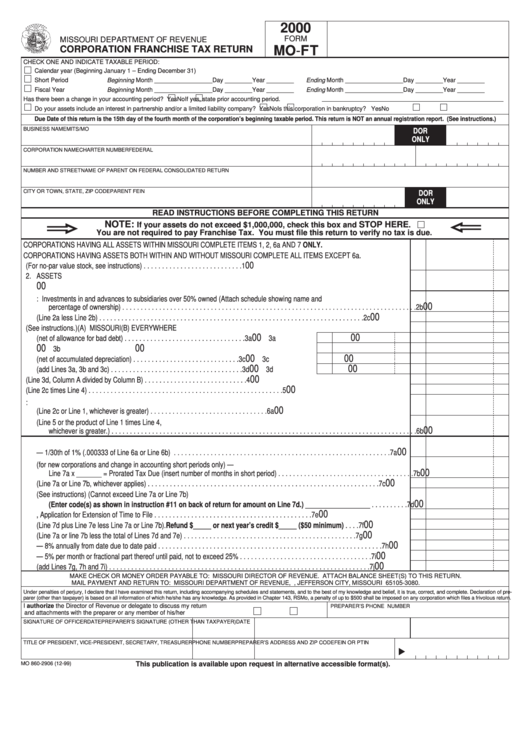

Form Mo 860-2906 - Corporation Franchise Tax Return - 2000

ADVERTISEMENT

2000

FORM

MISSOURI DEPARTMENT OF REVENUE

MO-FT

CORPORATION FRANCHISE TAX RETURN

CHECK ONE AND INDICATE TAXABLE PERIOD:

Calendar year (Beginning January 1 – Ending December 31)

Short Period

Beginning Month _________________ Day ________ Year ________

Ending Month _________________ Day ________ Year ________

Fiscal Year

Beginning Month _________________ Day ________ Year ________

Ending Month _________________ Day ________ Year ________

Has there been a change in your accounting period?

Yes

No

If yes, state prior accounting period.

Do your assets include an interest in partnership and/or a limited liability company?

Yes

No

Is this corporation in bankruptcy?

Yes

No

Due Date of this return is the 15th day of the fourth month of the corporation’s beginning taxable period. This return is NOT an annual registration report. (See instructions.)

BUSINESS NAME

MITS/MO I.D. NUMBER

DOR

ONLY

CORPORATION NAME

CHARTER NUMBER

FEDERAL I.D. NUMBER

NUMBER AND STREET

NAME OF PARENT ON FEDERAL CONSOLIDATED RETURN

CITY OR TOWN, STATE, ZIP CODE

PARENT FEIN

DOR

ONLY

READ INSTRUCTIONS BEFORE COMPLETING THIS RETURN

[

NOTE:

STOP HERE

If your assets do not exceed $1,000,000, check this box and

.

You are not required to pay Franchise Tax. You must file this return to verify no tax is due.

CORPORATIONS HAVING ALL ASSETS WITHIN MISSOURI COMPLETE ITEMS 1, 2, 6a AND 7 ONLY.

CORPORATIONS HAVING ASSETS BOTH WITHIN AND WITHOUT MISSOURI COMPLETE ALL ITEMS EXCEPT 6a.

00

1. PAR VALUE OF ISSUED and OUTSTANDING STOCK (For no-par value stock, see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2. ASSETS

00

2a. Total assets per ATTACHED BALANCE SHEET . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a

2b. Less: Investments in and advances to subsidiaries over 50% owned (Attach schedule showing name and

00

percentage of ownership) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b

00

2c. Adjusted total (Line 2a less Line 2b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c

3. ALLOCATION PER ATTACHED BALANCE SHEET OR SCHEDULE (See instructions.)

(A) MISSOURI

(B) EVERYWHERE

00

00

3a. Accounts receivable (net of allowance for bad debt) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a

3a

00

00

3b. Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3b

3b

00

00

3c. Land and fixed assets (net of accumulated depreciation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3c

3c

00

00

3d. Total allocated assets (add Lines 3a, 3b and 3c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3d

3d

00

4. MISSOURI PERCENTAGE FOR APPORTIONMENT (Line 3d, Column A divided by Column B) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5. ASSETS APPORTIONED TO MISSOURI (Line 2c times Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6. TAX BASIS:

00

6a. Corporations having all assets within Missouri (Line 2c or Line 1, whichever is greater) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a

6b. Corporations having assets both within and without Missouri (Line 5 or the product of Line 1 times Line 4,

00

whichever is greater.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6b

7. TAX COMPUTATION

00

7a. Tax — 1/30th of 1% (.000333 of Line 6a or Line 6b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7a

7b. SHORT PERIODS (for new corporations and change in accounting short periods only) —

00

Line 7a x _______ = Prorated Tax Due (insert number of months in short period) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7b

00

7c. Tax due (Line 7a or Line 7b, whichever applies) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7c

7d. Miscellaneous tax credits (See instructions) (Cannot exceed Line 7a or Line 7b)

00

(Enter code(s) as shown in instruction #11 on back of return for amount on Line 7d.) __________________ . . . . . . . . . . 7d

00

7e. Amount paid with Form MO-60, Application for Extension of Time to File . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7e

00

7f. OVERPAID (Line 7d plus Line 7e less Line 7a or Line 7b). Refund $_____ or next year’s credit $_____ ($50 minimum) . . . . 7f

00

7g. BALANCE DUE (Line 7a or line 7b less the total of Lines 7d and 7e) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7g

00

7h. Interest — 8% annually from date due to date paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7h

00

7i. PENALTY — 5% per month or fractional part thereof until paid, not to exceed 25% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7i

00

7j. TOTAL DUE (add Lines 7g, 7h and 7i) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7j

MAKE CHECK OR MONEY ORDER PAYABLE TO: MISSOURI DIRECTOR OF REVENUE. ATTACH BALANCE SHEET(S) TO THIS RETURN.

MAIL PAYMENT AND RETURN TO: MISSOURI DEPARTMENT OF REVENUE, P.O. BOX 3080, JEFFERSON CITY, MISSOURI 65105-3080.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of pre-

parer (other than taxpayer) is based on all information of which he/she has any knowledge. As provided in Chapter 143, RSMo, a penalty of up to $500 shall be imposed on any corporation which files a frivolous return.

I authorize the Director of Revenue or delegate to discuss my return

PREPARER’S PHONE NUMBER

and attachments with the preparer or any member of his/her firm.

YES

NO

SIGNATURE OF OFFICER

DATE

PREPARER’S SIGNATURE (OTHER THAN TAXPAYER)

DATE

TITLE OF PRESIDENT, VICE-PRESIDENT, SECRETARY, TREASURER PHONE NUMBER

PREPARER’S ADDRESS AND ZIP CODE

FEIN OR PTIN

MO 860-2906 (12-99)

This publication is available upon request in alternative accessible format(s).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1