Form It-Fc - Film Tax Credit - 2008 Page 2

ADVERTISEMENT

Form IT-FC 2008 (09/08)

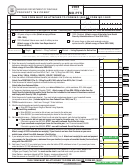

Calculation of Credit

Current Tax Year

1. Credit on Base Investment or Excess Base Investment

(a) Base Investment/Excess Base Investment in Georgia

____________________

(b) Percent of Credit for Base Investment

____________________

20%

(c) Tax Credit for Base Investment (multiply 1(a) by 1(b))

_________________

2. Additional Credit for Qualified Georgia Promotion

(a) Base Investment/Excess Base Investment in Georgia

____________________

(b) Percent of Credit for Qualified Georgia Promotion

____________________

10%

(c) Tax Credit for Qualified Georgia Promotion (multiply 2(a) by 2(b))

_________________

3. Total Current Year Tax Credit (Add lines 1(c) and 2(c))

Total Credit Allowed

_________________

4. Credit Carried Forward from Prior Years (From Line 12)

_________________

5. Total Credit Available in the Current Year (Line 3 plus Line 4)

_________________

6. Georgia Income Tax Liability for Current Year

_________________

7. Remaining Tax Credit (Line 5 minus Line 6, but no less than zero)

_________________

8. Amount to be claimed against Withholding (*See note below)

_________________

9. Remaining Credit to be Carried Forward

* Credit from previous years is not eligible to be utilized against withholding unless a timely election was made for the

respective prior year. In order to claim the withholding benefit, Form IT-WH must be filed at least 30 days prior to the

filing of the original income tax return.

Carry Forward Credit from Prior Tax Years

Specify Year(s)

_________________

10. Amount of Film Tax Credit Generated in Prior Years

_________________

11. Amount of Film Tax Credit Utilized or Transferred in Prior Years

_________________

12. Balance of Film Tax Credit Available to Carry Forward

Was any of the tax credit from Line 12:

Previously utilized against Withholding? _____________ If so, amount and year utilized _________________

Previously claimed against Income Taxes? ____________ If so, amount and year claimed _________________

Previously Transferred? ___________________________ If so, amount and year transferred ______________

Credit transfers must be documented on Form IT-TRANS and mailed to the address on that form or credit will not be allowed

when claimed by the transferee.

-2-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3