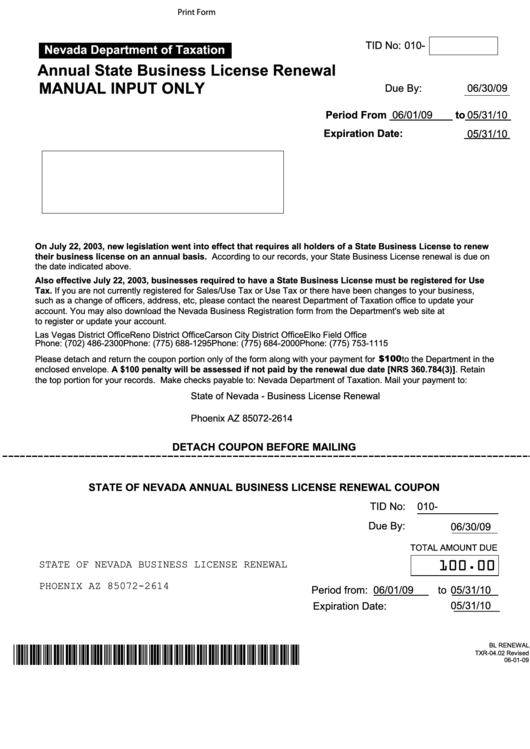

Print Form

TID No:

010-

Nevada Department of Taxation

Annual State Business License Renewal

MANUAL INPUT ONLY

Due By:

06/30/09

Period From ___________ to________

06/01/09

05/31/10

Expiration Date:

________

05/31/10

On July 22, 2003, new legislation went into effect that requires all holders of a State Business License to renew

their business license on an annual basis. According to our records, your State Business License renewal is due on

the date indicated above.

Also effective July 22, 2003, businesses required to have a State Business License must be registered for Use

Tax. If you are not currently registered for Sales/Use Tax or Use Tax or there have been changes to your business,

such as a change of officers, address, etc, please contact the nearest Department of Taxation office to update your

account. You may also download the Nevada Business Registration form from the Department's web site at http://

tax.state.nv.us to register or update your account.

Reno District Office

Carson City District Office

Elko Field Office

Las Vegas District Office

Phone: (702) 486-2300

Phone: (775) 688-1295

Phone: (775) 684-2000

Phone: (775) 753-1115

$100

Please detach and return the coupon portion only of the form along with your payment for

to the Department in the

enclosed envelope. A $100 penalty will be assessed if not paid by the renewal due date [NRS 360.784(3)]. Retain

the top portion for your records. Make checks payable to: Nevada Department of Taxation. Mail your payment to:

State of Nevada - Business License Renewal

P.O. Box 52614

Phoenix AZ 85072-2614

DETACH COUPON BEFORE MAILING

STATE OF NEVADA ANNUAL BUSINESS LICENSE RENEWAL COUPON

TID No:

010-

Due By:

06/30/09

TOTAL AMOUNT DUE

STATE OF NEVADA BUSINESS LICENSE RENEWAL

100.00

P.O. BOX 52614

PHOENIX AZ 85072-2614

Period from:

06/01/09

to

05/31/10

05/31/10

Expiration Date:

________

BL RENEWAL

*0100123456789000053110*

TXR-04.02 Revised

06-01-09

1

1