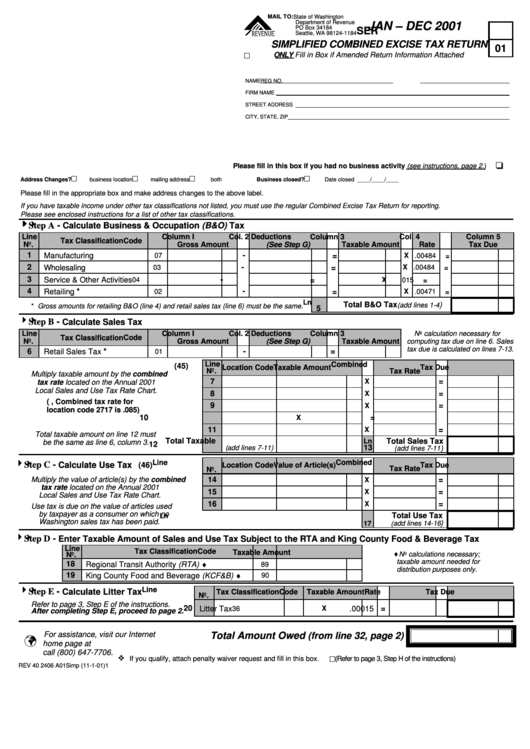

Simplified Combined Excise Tax Return Form - Washington Department Of Revenue - 2001

ADVERTISEMENT

MAIL TO: State of Washington

Department of Revenue

JAN – DEC 2001

PO Box 34184

SER

Seattle, WA 98124-1184

SIMPLIFIED COMBINED EXCISE TAX RETURN

01

ONLY Fill in Box if Amended Return Information Attached

!

NAME

REG NO.

FIRM NAME

STREET ADDRESS

CITY, STATE, ZIP

Please fill in this box if you had no business activity (see instructions, page 2.)

!

!

!

!

Address Changes?

business location

mailing address

both

Business closed?

Date closed ____/____/____

Please fill in the appropriate box and make address changes to the above label.

If you have taxable income under other tax classifications not listed, you must use the regular Combined Excise Tax Return for reporting.

Please see enclosed instructions for a list of other tax classifications.

! ! ! ! Step A -

Calculate Business & Occupation (B&O) Tax

Line

Column I

Col. 2 Deductions

Column 3

Col. 4

Column 5

Tax Classification

Code

No.

Gross Amount

(See Step G)

Taxable Amount

Rate

Tax Due

1

-

Manufacturing

07

=

X .00484

=

2

-

Wholesaling

=

X .00484

03

=

3

-

Service & Other Activities

04

=

X

.015

=

4

Retailing *

-

X .00471

02

=

=

Ln

Total B&O Tax

)

(add lines 1-4

* Gross amounts for retailing B&O (line 4) and retail sales tax (line 6) must be the same.

5

! ! ! ! Step B -

Calculate Sales Tax

Line

Column I

Col. 2 Deductions

Column 3

No calculation necessary for

Code

Tax Classification

(See Step G)

No.

Gross Amount

Taxable Amount

computing tax due on line 6. Sales

tax due is calculated on lines 7-13.

6

Retail Sales Tax *

-

=

01

Line

Combined

(45)

No. Location Code

Taxable Amount

Tax Due

Tax Rate

Multiply taxable amount by the combined

7

=

X

tax rate located on the Annual 2001

Local Sales and Use Tax Rate Chart.

8

=

X

(e.g., Combined tax rate for

9

=

X

location code 2717 is .085)

10

=

X

11

=

X

Total taxable amount on line 12 must

12 Total Taxable

Total Sales Tax

Ln

be the same as line 6, column 3.

13

(add lines 7-11)

)

(add lines 7-11

! ! ! ! Step C -

Combined

Line

Calculate Use Tax

(46)

Location Code

Value of Article(s)

Tax Due

Tax Rate

No.

Multiply the value of article(s) by the combined

14

=

X

tax rate located on the Annual 2001

15

=

X

Local Sales and Use Tax Rate Chart.

16

X

=

Use tax is due on the value of articles used

by taxpayer as a consumer on which no

Total Use Tax

Ln

Washington sales tax has been paid.

)

17

(add lines 14-16

! ! ! ! Step D -

Enter Taxable Amount of Sales and Use Tax Subject to the RTA and King County Food & Beverage Tax

Line

Tax Classification

Code

♦

Taxable Amount

No calculations necessary;

No.

Regional Transit Authority (RTA) ♦

taxable amount needed for

18

89

distribution purposes only.

King County Food and Beverage (KCF&B) ♦

19

90

! ! ! ! Step E -

Line

Calculate Litter Tax

No. Tax Classification Code

Taxable Amount

Rate

Tax Due

Refer to page 3, Step E of the instructions.

20 Litter Tax

X

.00015 =

36

After completing Step E, proceed to page 2.

For assistance, visit our Internet

Total Amount Owed (from line 32, page 2)

"

home page at or

call (800) 647-7706.

!

If you qualify, attach penalty waiver request and fill in this box

(Refer to page 3, Step H of the instructions)

.

!

REV 40 2406 A01Simp (11-1-01)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2