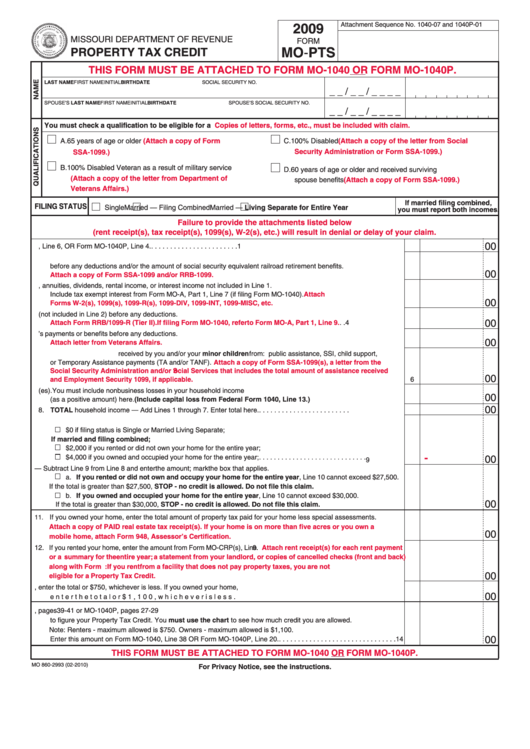

Form Mo-Pts - Property Tax Credit - 2009

ADVERTISEMENT

Attachment Sequence No. 1040-07 and 1040P-01

2009

MISSOURI DEPARTMENT OF REVENUE

FORM

PROPERTY TAX CREDIT

MO-PTS

THIS FORM MUST BE ATTACHED TO FORM MO-1040 OR FORM MO-1040P.

LAST NAME

FIRST NAME

INITIAL BIRTHDATE

SOCIAL SECURITY NO.

_ _ / _ _ / _ _ _ _

SPOUSE’S LAST NAME

FIRST NAME

INITIAL BIRTHDATE

SPOUSE’S SOCIAL SECURITY NO.

_ _ / _ _ / _ _ _ _

You must check a qualification to be eligible for a credit. Check only one.

Copies of letters, forms, etc., must be included with claim.

C. 100% Disabled

(Attach a copy of the letter from Social

A. 65 years of age or older

(Attach a copy of Form

Security Administration or Form SSA-1099.)

SSA-1099.)

B. 100% Disabled Veteran as a result of military service

D. 60 years of age or older and received surviving

(Attach a copy of the letter from Department of

spouse benefits

(Attach a copy of Form SSA-1099.)

Veterans Affairs.)

If married filing combined,

FILING STATUS

Single

Married — Filing Combined

Married — Living Separate for Entire Year

you must report both incomes.

Failure to provide the attachments listed below

(rent receipt(s), tax receipt(s), 1099(s), W-2(s), etc.) will result in denial or delay of your claim.

00

1. Enter the amount of income from Form MO-1040, Line 6, OR Form MO-1040P, Line 4. . . . . . . . . . . . . . . . . . . . . . . .

1

2. Enter the amount of nontaxable social security benefits received by you and/or your minor children

before any deductions and/or the amount of social security equivalent railroad retirement benefits.

00

Attach a copy of Form SSA-1099 and/or RRB-1099.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3. Enter the total amount of pensions, annuities, dividends, rental income, or interest income not included in Line 1.

Include tax exempt interest from Form MO-A, Part 1, Line 7 (if filing Form MO-1040).

Attach

00

Forms W-2(s), 1099(s), 1099-R(s), 1099-DIV, 1099-INT, 1099-MISC, etc.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4. Enter the amount of railroad retirement benefits (not included in Line 2) before any deductions.

Attach Form RRB/1099-R (Tier II). If filing Form MO-1040, refer to Form MO-A, Part 1, Line 9.

. . . . . . . . . . . . . . .

4

00

5. Enter the amount of veteran’s payments or benefits before any deductions.

Attach letter from Veterans Affairs.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

00

6. Enter the total amount received by you and/or your minor children from: public assistance, SSI, child support,

or Temporary Assistance payments (TA and/or TANF).

Attach a copy of Form SSA-1099(s), a letter from the

Social Security Administration and/or Social Services that includes the total amount of assistance received

00

and Employment Security 1099, if applicable.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

7. Enter the amount of nonbusiness loss(es). You must include nonbusiness losses in your household income

00

(as a positive amount) here. (Include capital loss from Federal Form 1040, Line 13.) . . . . . . . . . . . . . . . . . . . . . .

7

00

8. TOTAL household income — Add Lines 1 through 7. Enter total here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9. Mark the box that applies and enter the appropriate amount.

a. Enter $0 if filing status is Single or Married Living Separate;

If married and filing combined;

b. Enter $2,000 if you rented or did not own your home for the entire year;

c. Enter $4,000 if you owned and occupied your home for the entire year; . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

-

00

9

10. Net household income — Subtract Line 9 from Line 8 and enter the amount; mark the box that applies.

a. If you rented or did not own and occupy your home for the entire year, Line 10 cannot exceed $27,500.

If the total is greater than $27,500, STOP - no credit is allowed. Do not file this claim.

b. If you owned and occupied your home for the entire year, Line 10 cannot exceed $30,000.

00

If the total is greater than $30,000, STOP - no credit is allowed. Do not file this claim. . . . . . . . . . . . . . . . . . . . . .

10

If you owned your home, enter the total amount of property tax paid for your home less special assessments.

11.

Attach a copy of PAID real estate tax receipt(s). If your home is on more than five acres or you own a

00

mobile home, attach Form 948, Assessor’s Certification.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12. If you rented your home, enter the amount from Form MO-CRP(s), Line 9.

Attach rent receipt(s) for each rent payment

or a summary for the entire year; a statement from your landlord, or copies of cancelled checks (front and back)

along with Form MO-CRP. NOTE: If you rent from a facility that does not pay property taxes, you are not

00

eligible for a Property Tax Credit.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13. Add Lines 11 and 12. If you rented your home, enter the total or $750, whichever is less. If you owned your home,

00

enter the total or $1,100, whichever is less. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14. Apply Lines 10 and 13 to the chart in the instructions for MO-1040, pages 39-41 or MO-1040P, pages 27-29

to figure your Property Tax Credit. You must use the chart to see how much credit you are allowed.

Note: Renters - maximum allowed is $750. Owners - maximum allowed is $1,100.

Enter this amount on Form MO-1040, Line 38 OR Form MO-1040P, Line 20. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

THIS FORM MUST BE ATTACHED TO FORM MO-1040 OR FORM MO-1040P.

MO 860-2993 (02-2010)

For Privacy Notice, see the instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1