Electronic Data Interchange (Edi) Trading Partner Agreement Form - Pennsylvania Department Of Revenue

ADVERTISEMENT

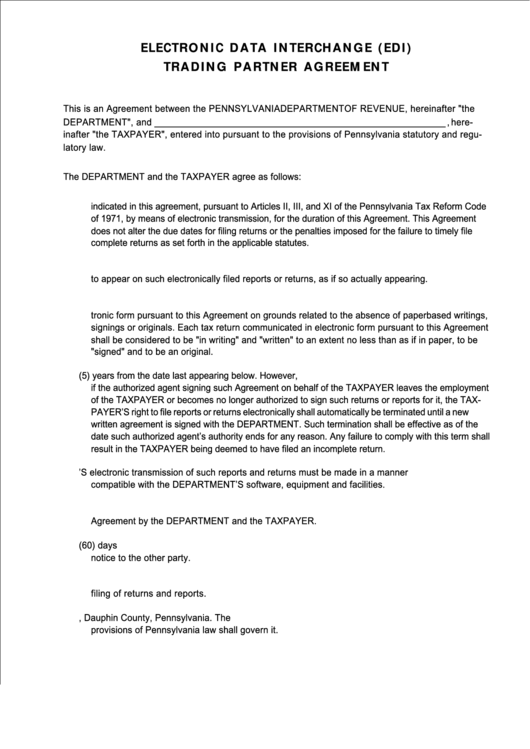

ELECTRONIC DATA INTERCHANGE (EDI)

TRADING PARTNER AGREEMENT

This is an Agreement between the PENNSYLVANIA DEPARTMENT OF REVENUE, hereinafter "the

DEPARTMENT", and _________________________________________________________________ , here-

inafter "the TAXPAYER", entered into pursuant to the provisions of Pennsylvania statutory and regu-

latory law.

The DEPARTMENT and the TAXPAYER agree as follows:

1. The DEPARTMENT authorizes the TAXPAYER to file those Pennsylvania Tax Returns specifically

indicated in this agreement, pursuant to Articles II, III, and XI of the Pennsylvania Tax Reform Code

of 1971, by means of electronic transmission, for the duration of this Agreement. This Agreement

does not alter the due dates for filing returns or the penalties imposed for the failure to timely file

complete returns as set forth in the applicable statutes.

2. The signature of the TAXPAYER or its authorized agent affixed to this Agreement shall be deemed

to appear on such electronically filed reports or returns, as if so actually appearing.

3. Neither party shall contest the validity or enforceability of the tax returns communicated in elec-

tronic form pursuant to this Agreement on grounds related to the absence of paperbased writings,

signings or originals. Each tax return communicated in electronic form pursuant to this Agreement

shall be considered to be "in writing" and "written" to an extent no less than as if in paper, to be

"signed" and to be an original.

4. The term of this Agreement shall be for five (5) years from the date last appearing below. However,

if the authorized agent signing such Agreement on behalf of the TAXPAYER leaves the employment

of the TAXPAYER or becomes no longer authorized to sign such returns or reports for it, the TAX-

PAYER’S right to file reports or returns electronically shall automatically be terminated until a new

written agreement is signed with the DEPARTMENT. Such termination shall be effective as of the

date such authorized agent’s authority ends for any reason. Any failure to comply with this term shall

result in the TAXPAYER being deemed to have filed an incomplete return.

5. The TAXPAYER’S electronic transmission of such reports and returns must be made in a manner

compatible with the DEPARTMENT’S software, equipment and facilities.

6. This Agreement can be amended at any time by the execution of a written addendum to this

Agreement by the DEPARTMENT and the TAXPAYER.

7. The DEPARTMENT or the TAXPAYER can cancel this Agreement at any time upon sixty (60) days

notice to the other party.

8. This Agreement represents the entire understanding of the parties in relation to the electronic

filing of returns and reports.

9. The place of performance of this Agreement is Harrisburg, Dauphin County, Pennsylvania. The

provisions of Pennsylvania law shall govern it.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2