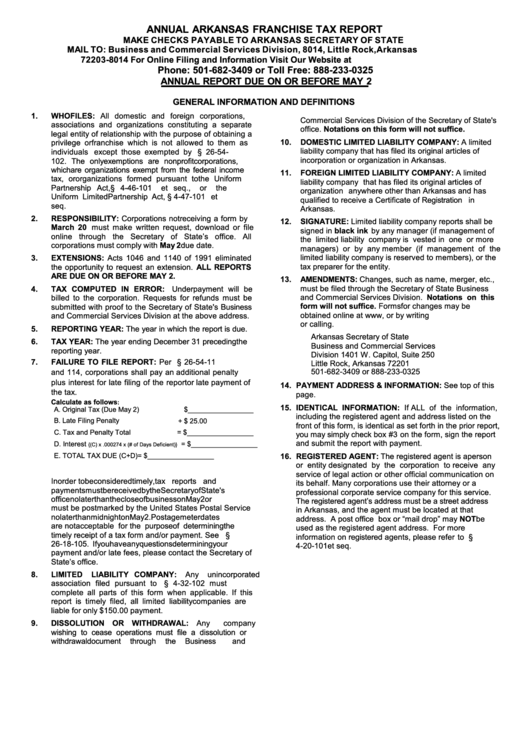

ANNUAL ARKANSAS FRANCHISE TAX REPORT

MAKE CHECKS PAYABLE TO ARKANSAS SECRETARY OF STATE

MAIL TO: Business and Commercial Services Division, P.O. Box 8014, Little Rock, Arkansas

72203-8014 For Online Filing and Information Visit Our Website at

Phone: 501-682-3409 or Toll Free: 888-233-0325

ANNUAL REPORT DUE ON OR BEFORE MAY 2

GENERAL INFORMATION AND DEFINITIONS

1.

WHO FILES: All domestic and foreign corporations,

Commercial Services Division of the Secretary of State's

associations and organizations constituting a separate

office. Notations on this form will not suffice.

legal entity of relationship with the purpose of obtaining a

10.

DOMESTIC LIMITED LIABILITY COMPANY: A limited

privilege or franchise which is not allowed to them as

liability company that has filed its original articles of

individuals except those exempted by A.C.A. § 26-54-

102. The only exemptions are nonprofit corporations,

incorporation or organization in Arkansas.

which are organizations exempt from the federal income

11.

FOREIGN LIMITED LIABILITY COMPANY: A limited

tax, or organizations formed pursuant to the Uniform

liability company that has filed its original articles of

Partnership Act, A.C.A. § 4-46-101 et seq., or the

organization anywhere other than Arkansas and has

Uniform Limited Partnership Act, A.C.A. § 4-47-101 et

qualified to receive a Certificate of Registration in

seq.

Arkansas.

2.

RESPONSIBILITY: Corporations not receiving a form by

12.

SIGNATURE: Limited liability company reports shall be

March 20 must make written request, download or file

signed in black ink by any manager (if management of

online through the Secretary of State’s office. All

the limited liability company is vested in one or more

corporations must comply with May 2 due date.

managers) or by any member (if management of the

3.

limited liability company is reserved to members), or the

EXTENSIONS: Acts 1046 and 1140 of 1991 eliminated

tax preparer for the entity.

the opportunity to request an extension. ALL REPORTS

ARE DUE ON OR BEFORE MAY 2.

13.

AMENDMENTS: Changes, such as name, merger, etc.,

4.

must be filed through the Secretary of State Business

TAX COMPUTED IN ERROR: Underpayment will be

and Commercial Services Division. Notations on this

billed to the corporation. Requests for refunds must be

form will not suffice. Forms for changes may be

submitted with proof to the Secretary of State's Business

obtained online at , or by writing

and Commercial Services Division at the above address.

or calling.

5.

REPORTING YEAR: The year in which the report is due.

Arkansas Secretary of State

6.

TAX YEAR: The year ending December 31 preceding the

Business and Commercial Services

reporting year.

Division 1401 W. Capitol, Suite 250

7.

FAILURE TO FILE REPORT: Per A.C.A. § 26-54-11

Little Rock, Arkansas 72201

and 114, corporations shall pay an additional penalty

501-682-3409 or 888-233-0325

plus interest for late filing of the report or late payment of

14. PAYMENT ADDRESS & INFORMATION: See top of this

the tax.

page.

Calculate as follows

:

15. IDENTICAL INFORMATION: If ALL of the information,

A. Original Tax (Due May 2)

$_________________

including the registered agent and address listed on the

B. Late Filing Penalty

+ $ 25.00

front of this form, is identical as set forth in the prior report,

C. Tax and Penalty Total

= $_________________

you may simply check box #3 on the form, sign the report

and submit the report with payment.

D. Interest

= $_________________

{(C) x .000274 x (# of Days Deficient)}

E. TOTAL TAX DUE (C+D)

= $_________________

16. REGISTERED AGENT: The registered agent is a person

or entity designated by the corporation to receive any

service of legal action or other official communication on

In order to be considered timely, tax reports and

its behalf. Many corporations use their attorney or a

payments must be received by the Secretary of State's

professional corporate service company for this service.

office no later than the close of business on May 2 or

The registered agent’s address must be a street address

must be postmarked by the United States Postal Service

in Arkansas, and the agent must be located at that

no later than midnight on May 2. Postage meter dates

address. A post office box or “mail drop” may NOT be

are not acceptable for the purpose of determining the

used as the registered agent address. For more

timely receipt of a tax form and/or payment. See A.C.A. §

information on registered agents, please refer to A.C.A. §

26-18-105. If you have any questions determining your

4-20-101 et seq.

payment and/or late fees, please contact the Secretary of

State’s office.

8.

LIMITED LIABILITY COMPANY: Any unincorporated

association filed pursuant to A.C.A. § 4-32-102 must

complete all parts of this form when applicable. If this

report is timely filed, all limited liability companies are

liable for only $150.00 payment.

9.

DISSOLUTION OR WITHDRAWAL: Any company

wishing to cease operations must file a dissolution or

withdrawal

document

through

the

Business

and

1

1