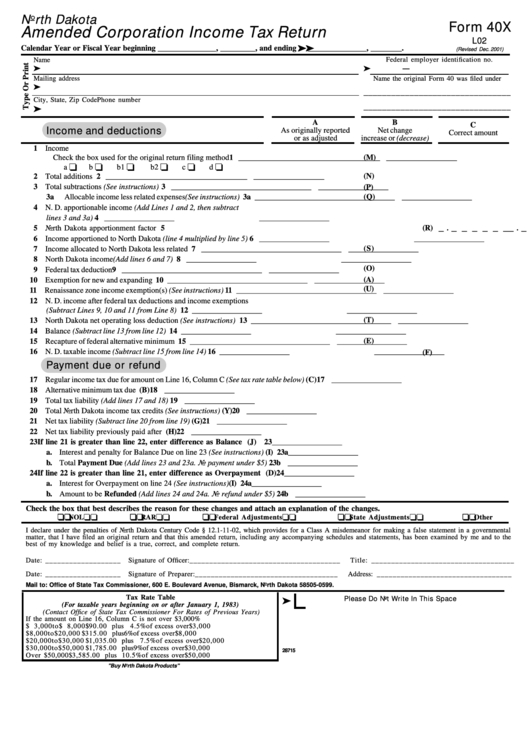

Form 40x L02 - North Dakota Amended Corporation Income Tax Return - 2001

ADVERTISEMENT

North Dakota

Form 40X

Amended Corporation Income Tax Return

L02

Calendar Year or Fiscal Year beginning _______________, _________, and ending ® ® ® ® ® _______________, ________.

(Revised Dec. 2001)

Name

Federal employer identification no.

®

®

—

Mailing address

Name the original Form 40 was filed under

®

________________________________

City, State, Zip Code

Phone number

________________________________

®

A

B

C

Income and deductions

As originally reported

Net change

Correct amount

or as adjusted

increase or (decrease)

1 Income .................................................................................................

(M)

Check the box used for the original return filing method

1 __________________ __________________ __________________

a J

b J

b1 J

b2 J

c J

d J

(N)

2 Total additions .....................................................................................

2 __________________ __________________ __________________

3 Total subtractions (See instructions) ...................................................

3 __________________ __________________ __________________

(P)

(Q)

3a

Allocable income less related expenses (See instructions) ..........

3a __________________ __________________ __________________

4 N. D. apportionable income (Add Lines 1 and 2, then subtract

lines 3 and 3a) .....................................................................................

4 __________________

__________________

_ . _ _ _ _ _ _

_ . _ _ _ _ _ _

(R)

5 North Dakota apportionment factor ...................................................

5

6 Income apportioned to North Dakota (line 4 multiplied by line 5) ......

6 __________________

__________________

(S)

7 Income allocated to North Dakota less related expenses .....................

7 __________________ __________________ __________________

8 North Dakota income (Add lines 6 and 7) ...........................................

8 __________________

__________________

(O)

9 Federal tax deduction ...........................................................................

9 __________________ __________________ __________________

(A)

10 Exemption for new and expanding business ........................................

10 __________________ __________________ __________________

(U)

11 Renaissance zone income exemption(s) (See instructions) ..................

11 __________________ __________________ __________________

12 N. D. income after federal tax deductions and income exemptions

(Subtract Lines 9, 10 and 11 from Line 8) ...........................................

12 __________________

__________________

(T)

13 North Dakota net operating loss deduction (See instructions) ............

13 __________________ __________________ __________________

14 Balance (Subtract line 13 from line 12) ................................................

14 __________________

__________________

(E)

15 Recapture of federal alternative minimum tax .....................................

15 __________________ __________________ __________________

16 N. D. taxable income (Subtract line 15 from line 14) ...........................

16 __________________

__________________

(F)

Payment due or refund

17 Regular income tax due for amount on Line 16, Column C (See tax rate table below) ................................................ (C) 17 __________________

18 Alternative minimum tax due ....................................................................................................................................... (B) 18 __________________

19 Total tax liability (Add lines 17 and 18) ......................................................................................................................

19 __________________

20 Total North Dakota income tax credits (See instructions) ........................................................................................... (Y) 20 __________________

21 Net tax liability (Subtract line 20 from line 19) ........................................................................................................... (G) 21 __________________

22 Net tax liability previously paid after credits .............................................................................................................. (H) 22 __________________

23 If line 21 is greater than line 22, enter difference as Balance Due .................................................................... (J) 23 __________________

a. Interest and penalty for Balance Due on line 23 (See instructions) ......................................................................

(I) 23a __________________

b. Total Payment Due (Add lines 23 and 23a. No payment under $5) ....................................................................

23b __________________

24 If line 22 is greater than line 21, enter difference as Overpayment .................................................................. (D) 24 __________________

a. Interest for Overpayment on line 24 (See instructions) ........................................................................................

(I) 24a __________________

b. Amount to be Refunded (Add lines 24 and 24a. No refund under $5) ................................................................

24b __________________

Check the box that best describes the reason for these changes and attach an explanation of the changes.

J J J J J NOL

J J J J J RAR

J J J J J Federal Adjustments

J J J J J State Adjustments

J J J J J Other

I declare under the penalties of North Dakota Century Code § 12.1-11-02, which provides for a Class A misdemeanor for making a false statement in a governmental

matter, that I have filed an original return and that this amended return, including any accompanying schedules and statements, has been examined by me and to the

best of my knowledge and belief is a true, correct, and complete return.

Date: ___________________

Signature of Officer: ______________________________________

Title: ____________________________________

Date: ___________________

Signature of Preparer: ____________________________________

Address: __________________________________

Mail to: Office of State Tax Commissioner, 600 E. Boulevard Avenue, Bismarck, North Dakota 58505-0599.

Tax Rate Table

®

Please Do Not Write In This Space

(For taxable years beginning on or after January 1, 1983)

(Contact Office of State Tax Commissioner For Rates of Previous Years)

If the amount on Line 16, Column C is not over $3,000 ....................................... 3%

$ 3,000 t o $ 8,000 ....

$

90.00 plus 4.5%

of excess over $

3,000

$ 8,000 t o $ 20,000 ....

$ 315.00 plus

6%

of excess over $

8,000

$ 20,000 t o $ 30,000 ....

$1,035.00 plus 7.5%

of excess over $ 20,000

$ 30,000 t o $ 50,000 ....

$1,785.00 plus

9%

of excess over $ 30,000

28715

Over $50,000 ...................

$3,585.00 plus 10.5%

of excess over $ 50,000

"Buy North Dakota Products"

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1