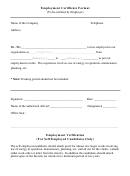

INSTRUCTIONS

The Employment Verification Record is used to determine eligibility for retiree insurance.

If you are retiring within 90 days, please submit the Retiree Notice of Election (RNOE) to PEBA

Insurance Benefits with the Employment Verification Record. If you are eligible for retiree coverage,

PEBA Insurance Benefits will need both of these forms to process your enrollment in retiree coverage.

These forms must be sent no later than 31 days after your retirement date.

If you are not ready to retire, but are inquiring about your eligibility in the future, you may submit the

Employment Verification Record to PEBA Insurance Benefits with a letter indicating your anticipated

retirement date. Please note: PEBA Insurance Benefits will verify eligibility for retiree insurance no

more than 6 months prior to retirement.

Mail forms to: PEBA Insurance Benefits

P. O. Box 11661

Columbia, SC 29211

Block 6 – Type of Retirement

Service Retirement indicates eligibility is based solely on the years of service credited through one of the

retirement systems administered by the S.C. Public Employee Benefit Authority. Disability Retirement

indicates eligibility based on qualification as a disabled retiree. Please attach a copy of your disability

approval letter from one of the retirement systems administered by the S.C. Public Employee Benefit

Authority.

Block 8 – Actual Date of Retirement

List the date of retirement established with one of the retirement systems administered by the S.C. Public

Employee Benefit Authority. If you continued working in a full-time benefits eligible position after your

retirement date, list the date you left active employment* or your TERI end date whichever is later.

*For retirement purposes, when a member begins TERI, he is retired.

Block 9 – Name of Current Employer

List the name of your current state or local subdivision employer. If you are not currently employed by

an employer participating in PEBA Insurance Benefits, do not complete this section. Proceed to Block

10.

Block 10 – Previous Employers

List all previous employment with employers participating in one of the retirement systems administered

by the S.C. Public Employee Benefit Authority and/or with a Local Subdivision participating in PEBA

Insurance Benefits. Please include service time established in the appropriate sections.

Block 11 – Additional Service Time

If you purchased service or reestablished service, please list the total number of years established.

Block 12 - Total Years of Service Credit – This number is calculated by adding the total years of service

from blocks 9, 10 and 11. If you are submitting a Retiree Notice of Election (RNOE) to enroll in retiree

coverage, this information is required in the eligibility section of the form.

Please note: PEBA Insurance Benefits cannot process your enrollment in retiree coverage

until you employer terminates your active insurance coverage. Please notify your employer of

your retirement date as soon as possible to ensure timely processing of your retiree enrollment.

1

1 2

2