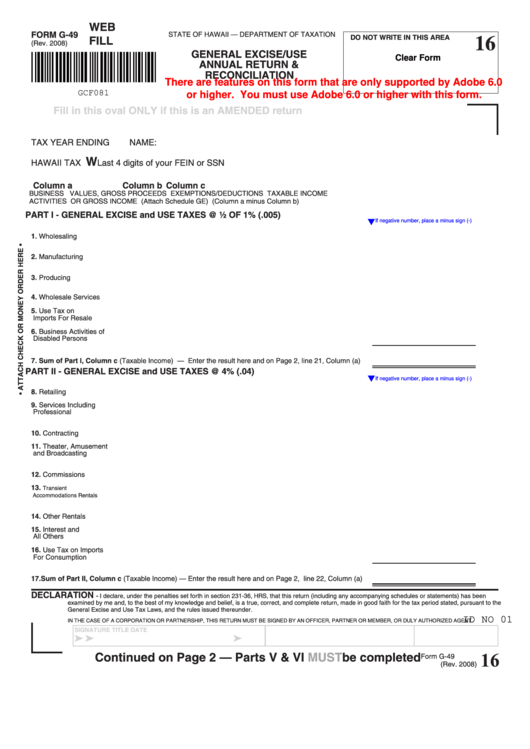

WEB

FORM G-49

16

FILL

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE IN THIS AREA

(Rev. 2008)

GENERAL EXCISE/USE

Clear Form

ANNUAL RETURN &

RECONCILIATION

There are features on this form that are only supported by Adobe 6.0

GCF081

or higher. You must use Adobe 6.0 or higher with this form.

Fill in this oval ONLY if this is an AMENDED return

TAX YEAR ENDING

NAME:

W

HAWAII TAX I.D. NO.

Last 4 digits of your FEIN or SSN

Column a

Column b

Column c

BUSINESS

VALUES, GROSS PROCEEDS

EXEMPTIONS/DEDUCTIONS

TAXABLE INCOME

ACTIVITIES

OR GROSS INCOME

(Attach Schedule GE)

(Column a minus Column b)

PART I - GENERAL EXCISE and USE TAXES @ ½ OF 1% (.005)

If negative number, place a minus sign (-)

1. Wholesaling

2. Manufacturing

3. Producing

4. Wholesale Services

5. Use Tax on

Imports For Resale

6. Business Activities of

Disabled Persons

7. Sum of Part I, Column c (Taxable Income) — Enter the result here and on Page 2, line 21, Column (a)

PART II - GENERAL EXCISE and USE TAXES @ 4% (.04)

If negative number, place a minus sign (-)

8. Retailing

9. Services Including

Professional

10. Contracting

11. Theater, Amusement

and Broadcasting

12. Commissions

13. Transient

Accommodations Rentals

14. Other Rentals

15. Interest and

All Others

16. Use Tax on Imports

For Consumption

17. Sum of Part II, Column c (Taxable Income) — Enter the result here and on Page 2, line 22, Column (a)

DECLARATION

- I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been

examined by me and, to the best of my knowledge and belief, is a true, correct, and complete return, made in good faith for the tax period stated, pursuant to the

General Excise and Use Tax Laws, and the rules issued thereunder.

ID NO 01

IN THE CASE OF A CORPORATION OR PARTNERSHIP, THIS RETURN MUST BE SIGNED BY AN OFFICER, PARTNER OR MEMBER, OR DULY AUTHORIZED AGENT.

SIGNATURE

TITLE

DATE

ä

ä

ä

16

Continued on Page 2 — Parts V & VI

MUST

be completed

Form G-49

(Rev. 2008)

1

1 2

2 3

3 4

4