Form P85 - Leaving The Uk - Getting Your Tax Right

ADVERTISEMENT

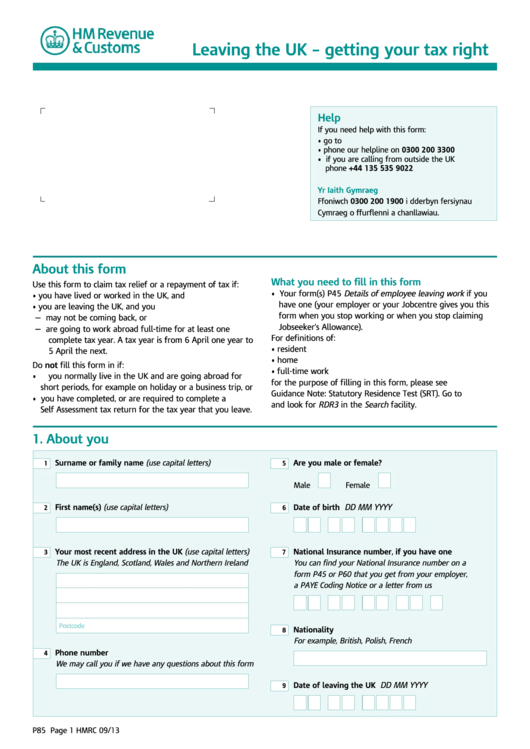

Leaving the UK – getting your tax right

Help

If you need help with this form:

• go to

• phone our helpline on 0300 200 3300

• if you are calling from outside the UK

phone +44 135 535 9022

Yr Iaith Gymraeg

Ffoniwch 0300 200 1900 i dderbyn fersiynau

Cymraeg o ffurflenni a chanllawiau.

About this form

What you need to fill in this form

Use this form to claim tax relief or a repayment of tax if:

• Your form(s) P45 Details of employee leaving work if you

• you have lived or worked in the UK, and

have one (your employer or your Jobcentre gives you this

• you are leaving the UK, and you

form when you stop working or when you stop claiming

— may not be coming back, or

Jobseeker’s Allowance).

— are going to work abroad full-time for at least one

For definitions of:

complete tax year. A tax year is from 6 April one year to

• resident

5 April the next.

• home

Do not fill this form in if:

• full-time work

• you normally live in the UK and are going abroad for

for the purpose of filling in this form, please see

short periods, for example on holiday or a business trip, or

Guidance Note: Statutory Residence Test (SRT). Go to

• you have completed, or are required to complete a

and look for RDR3 in the Search facility.

Self Assessment tax return for the tax year that you leave.

1. About you

Surname or family name (use capital letters)

Are you male or female?

1

5

Male

Female

First name(s) (use capital letters)

Date of birth

DD MM YYYY

2

6

Your most recent address in the UK (use capital letters)

National Insurance number, if you have one

3

7

The UK is England, Scotland, Wales and Northern Ireland

You can find your National Insurance number on a

form P45 or P60 that you get from your employer,

a PAYE Coding Notice or a letter from us

Postcode

Nationality

8

For example, British, Polish, French

Phone number

4

We may call you if we have any questions about this form

Date of leaving the UK

DD MM YYYY

9

P85

Page 1

HMRC 09/13

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4