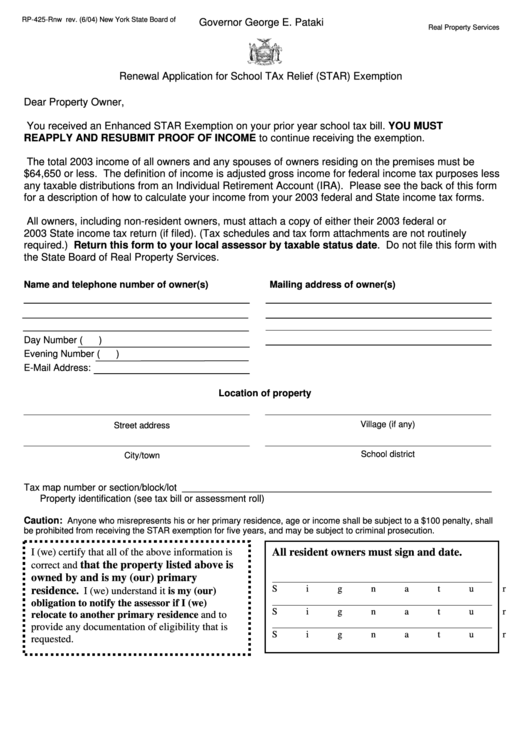

Form Rp-425-Rnw - Renewal Application For School Tax Relief (Star) Exemption - New York State Board Of Real Property Services

ADVERTISEMENT

RP-425-Rnw rev. (6/04)

New York State Board of

Governor George E. Pataki

Real Property Services

Renewal Application for School TAx Relief (STAR) Exemption

Dear Property Owner,

You received an Enhanced STAR Exemption on your prior year school tax bill. YOU MUST

REAPPLY AND RESUBMIT PROOF OF INCOME to continue receiving the exemption.

The total 2003 income of all owners and any spouses of owners residing on the premises must be

$64,650 or less. The definition of income is adjusted gross income for federal income tax purposes less

any taxable distributions from an Individual Retirement Account (IRA). Please see the back of this form

for a description of how to calculate your income from your 2003 federal and State income tax forms.

All owners, including non-resident owners, must attach a copy of either their 2003 federal or

2003 State income tax return (if filed). (Tax schedules and tax form attachments are not routinely

required.) Return this form to your local assessor by taxable status date. Do not file this form with

the State Board of Real Property Services.

Name and telephone number of owner(s)

Mailing address of owner(s)

Day Number (

)

Evening Number (

)

E-Mail Address:

Location of property

Village (if any)

Street address

School district

City/town

Tax map number or section/block/lot ___________________________________________________________

Property identification (see tax bill or assessment roll)

Caution:

Anyone who misrepresents his or her primary residence, age or income shall be subject to a $100 penalty, shall

be prohibited from receiving the STAR exemption for five years, and may be subject to criminal prosecution.

All resident owners must sign and date.

I (we) certify that all of the above information is

that the property listed above is

correct and

owned by and is my (our) primary

Signature

Date

residence

. I (we) understand it is my (our)

obligation to notify the assessor if I (we)

Signature

Date

relocate to another primary residence and to

provide any documentation of eligibility that is

Signature

Date

requested.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2