Bristol Virginia Transient Occupancy Tax Form - Virginia Commissioner Of The Revenue

ADVERTISEMENT

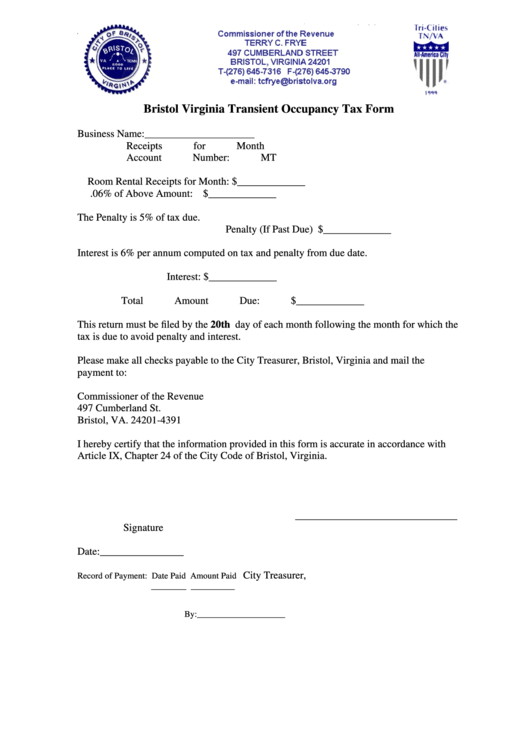

Bristol Virginia Transient Occupancy Tax Form

Business Name:_____________________

Receipts for Month

Account Number: MT

Room Rental Receipts for Month: $_____________

.06% of Above Amount: $_____________

The Penalty is 5% of tax due.

Penalty (If Past Due) $_____________

Interest is 6% per annum computed on tax and penalty from due date.

Interest: $_____________

Total Amount Due: $_____________

This return must be filed by the 20th day of each month following the month for which the

tax is due to avoid penalty and interest.

Please make all checks payable to the City Treasurer, Bristol, Virginia and mail the

payment to:

Commissioner of the Revenue

497 Cumberland St.

Bristol, VA. 24201-4391

I hereby certify that the information provided in this form is accurate in accordance with

Article IX, Chapter 24 of the City Code of Bristol, Virginia.

_______________________________

Signature

Date:________________

City Treasurer,

Record of Payment: Date Paid

Amount Paid

________

__________

By:____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1