Form D-403 - Partnership Income Tax Return - 2009 Page 4

ADVERTISEMENT

Page 4

Legal Name (First 10 Characters)

Federal Employer ID Number

D-403

Web

9-09

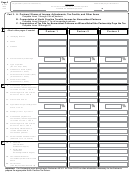

Part 4. North Carolina Adjustments to Federal Taxable Income

(See instructions.)

Additions to Federal Taxable Income

.

00

1.

1. Interest income from obligations of states other than North Carolina

.

00

2. State, local, or foreign income taxes deducted on the federal return

2.

.

00

3. Adjustment for bonus depreciation

3.

.

4. Other additions to federal taxable income (See Form D-401, Individual Income Tax Instructions, for other additions

00

that may be applicable to partnerships)

4.

.

00

5. Total additions to federal taxable income (Add Lines 1 through 4 and enter total here and on Part 1, Line 4)

5.

Deductions from Federal Taxable Income

.

00

6. Interest income from obligations of the United States or United States’ possessions

6.

.

00

7.

7. State, local, or foreign income tax refunds reported as income on federal return

.

8. Adjustment for additional first-year depreciation added back in 2002, 2003, and 2004

00

8.

(See Line instructions)

.

00

9. Adjustment for bonus depreciation added back in 2008 (See Line instructions)

9.

.

10. Other deductions from federal taxable income (See Form D-401, Individual Income Tax Instructions, for other

00

10.

deductions that may be applicable to partnerships)

.

00

11. Total deductions from federal taxable income (Add Lines 6, 7, 8, 9, and 10 and enter total here and on Part 1, Line 6)

11.

Tax Rate Schedule

If the amount of each nonresident

partner’s share of N.C. taxable income

But not over

The tax is

(from Part 3, Line 17) is more than

$0

$12,750

6% of the taxable income

$12,750

$60,000

$765 + 7% of taxable income over $12,750

$60,000

- - - -

$4,072.50 + 7.75% of taxable income over $60,000

Surtax Percentage Table

If NC Taxable Income

shown for nonresident

The Applicable

partner on Part 3, Line 17 is

Percentage is

Greater than $60,000 but does not exceed $150,000

2%

Greater than $150,000

3%

Surtax Computation

X

=

NC income tax

Applicable percentage

Surtax

(Enter amount from

(from table above)

(Enter the surtax

Part 3, Line 18a for

due on Part 3,

nonresident partner)

Line 18b)

I certify that, to the best of my knowledge, this return is accurate and complete.

If prepared by a person other than the managing partner, this certification is based

on all information of which preparer has any knowledge.

Signature of Managing Partner

Date

Signature of Preparer Other Than Managing Partner

Date

Address

Daytime Telephone Number (Include area code)

Preparer’s Daytime Telephone Number (Include area code)

If entity is an LLC and it converted to an LLC during the tax year, enter entity name prior to conversion:

MAIL TO: North Carolina Department of Revenue, P.O. Box 25000, Raleigh, North Carolina 27640-0645

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4