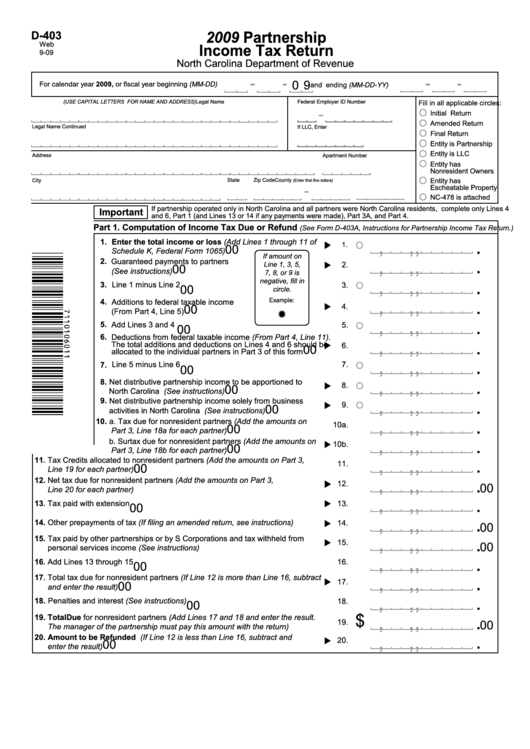

Form D-403 - Partnership Income Tax Return - 2009

ADVERTISEMENT

2009 Partnership

D-403

Web

Income Tax Return

9-09

North Carolina Department of Revenue

0 9

For calendar year 2009, or fiscal year beginning (MM-DD)

and ending (MM-DD-YY)

Legal Name

(USE CAPITAL LETTERS FOR NAME AND ADDRESS)

Fill in all applicable circles:

Federal Employer ID Number

Initial Return

Amended Return

Legal Name Continued

If LLC, Enter N.C. Secretary of State ID

Final Return

Entity is Partnership

Entity is LLC

Address

Apartment Number

Entity has

Nonresident Owners

Entity has

City

State

Zip Code

County

(Enter first five letters)

Escheatable Property

NC-478 is attached

If partnership operated only in North Carolina and all partners were North Carolina residents, complete only Lines 4

Important

and 6, Part 1 (and Lines 13 or 14 if any payments were made), Part 3A, and Part 4.

Part 1. Computation of Income Tax Due or Refund

(See Form D-403A, Instructions for Partnership Income Tax Return.)

,

,

,

.

1. Enter the total income or loss (Add Lines 1 through 11 of

1.

00

Schedule K, Federal Form 1065)

If amount on

,

,

,

.

2. Guaranteed payments to partners

2.

Line 1, 3, 5,

00

(See instructions)

7, 8, or 9 is

,

,

,

.

negative, fill in

3. Line 1 minus Line 2

3.

00

circle.

,

,

,

.

Example:

4. Additions to federal taxable income

4.

00

(From Part 4, Line 5)

,

,

,

.

5. Add Lines 3 and 4

5.

00

6. Deductions from federal taxable income (From Part 4, Line 11).

,

,

,

.

The total additions and deductions on Lines 4 and 6 should be

6.

00

allocated to the individual partners in Part 3 of this form

,

,

,

.

7. Line 5 minus Line 6

7.

00

,

,

,

.

8. Net distributive partnership income to be apportioned to

8.

00

North Carolina (See instructions)

,

,

,

.

9. Net distributive partnership income solely from business

9.

00

activities in North Carolina (See instructions)

,

,

,

.

10. a. Tax due for nonresident partners (Add the amounts on

10a.

00

Part 3, Line 18a for each partner)

,

,

,

.

b. Surtax due for nonresident partners (Add the amounts on

10b.

00

Part 3, Line 18b for each partner)

,

,

,

.

11

Tax Credits allocated to nonresident partners (Add the amounts on Part 3,

.

11.

00

Line 19 for each partner)

,

,

,

.

12.

Net tax due for nonresident partners (Add the amounts on Part 3,

12.

00

Line 20 for each partner)

,

,

,

.

13

Tax paid with extension

13.

.

00

,

,

,

.

14.

Other prepayments of tax (If filing an amended return, see instructions)

14.

00

,

,

,

.

15.

Tax paid by other partnerships or by S Corporations and tax withheld from

15.

00

personal services income (See instructions)

,

,

,

.

16

Add Lines 13 through 15

16.

.

00

,

,

,

.

17

Total tax due for nonresident partners (If Line 12 is more than Line 16, subtract

.

17.

00

and enter the result)

,

,

,

.

18. Penalties and interest (See instructions)

18.

00

,

,

,

.

$

19.

Total Due for nonresident partners (Add Lines 17 and 18 and enter the result.

19

00

.

The manager of the partnership must pay this amount with the return)

,

,

,

.

20. Amount to be Refunded (If Line 12 is less than Line 16, subtract and

20.

00

enter the result)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

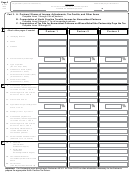

1

1 2

2 3

3 4

4