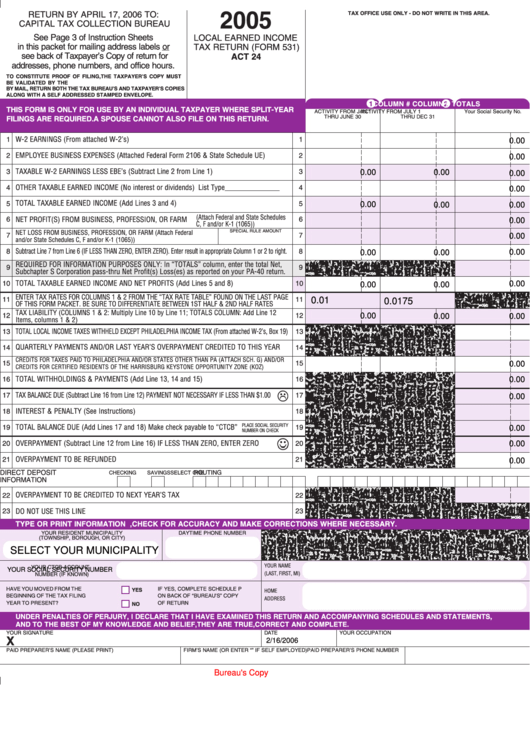

RETURN BY APRIL 17, 2006 TO:

2005

TAX OFFICE USE ONLY - DO NOT WRITE IN THIS AREA.

CAPITAL TAX COLLECTION BUREAU

See Page 3 of Instruction Sheets

LOCAL EARNED INCOME

in this packet for mailing address labels or

TAX RETURN (FORM 531)

see back of Taxpayer’s Copy of return for

ACT 24

Click Here to Clear Form Data

addresses, phone numbers, and office hours.

TO CONSTITUTE PROOF OF FILING, THE TAXPAYER’S COPY MUST

BE VALIDATED BY THE BUREAU. TO HAVE YOUR COPY VALIDATED

BY MAIL, RETURN BOTH THE TAX BUREAU’S AND TAXPAYER’S COPIES

ALONG WITH A SELF ADDRESSED STAMPED ENVELOPE.

COLUMN #

1

COLUMN #

2

TOTALS

THIS FORM IS ONLY FOR USE BY AN INDIVIDUAL TAXPAYER WHERE SPLIT-YEAR

ACTIVITY FROM JAN. 1

ACTIVITY FROM JULY 1

Your Social Security No.

THRU JUNE 30

THRU DEC 31

FILINGS ARE REQUIRED. A SPOUSE CANNOT ALSO FILE ON THIS RETURN.

W-2 EARNINGS (From attached W-2’s)

1

1

0.00

EMPLOYEE BUSINESS EXPENSES (Attached Federal Form 2106 & State Schedule UE)

2

2

0.00

TAXABLE W-2 EARNINGS LESS EBE’s (Subtract Line 2 from Line 1)

3

3

0.00

0.00

0.00

OTHER TAXABLE EARNED INCOME (No interest or dividends) List Type _______________

4

4

0.00

TOTAL TAXABLE EARNED INCOME (Add Lines 3 and 4)

5

5

0.00

0.00

0.00

(Attach Federal and State Schedules

NET PROFIT(S) FROM BUSINESS, PROFESSION, OR FARM

6

6

0.00

C, F and/or K-1 (1065))

SPECIAL RULE AMOUNT

NET LOSS FROM BUSINESS, PROFESSION, OR FARM (Attach Federal

7

7

0.00

and/or State Schedules C, F and/or K-1 (1065))

Subtract Line 7 from Line 6 (IF LESS THAN ZERO, ENTER ZERO). Enter result in appropriate Column 1 or 2 to right.

0.00

8

8

0.00

0.00

REQUIRED FOR INFORMATION PURPOSES ONLY: In “TOTALS” column, enter the total Net,

9

9

Subchapter S Corporation pass-thru Net Profit(s) Loss(es) as reported on your PA-40 return.

TOTAL TAXABLE EARNED INCOME AND NET PROFITS (Add Lines 5 and 8)

0.00

10

10

0.00

0.00

ENTER TAX RATES FOR COLUMNS 1 & 2 FROM THE “TAX RATE TABLE” FOUND ON THE LAST PAGE

0.01

11

11

0.0175

OF THIS FORM PACKET. BE SURE TO DIFFERENTIATE BETWEEN 1ST HALF & 2ND HALF RATES

TAX LIABILITY (COLUMNS 1 & 2: Multiply Line 10 by Line 11; TOTALS COLUMN: Add Line 12

12

12

0.00

0.00

0.00

Items, columns 1 & 2)

TOTAL LOCAL INCOME TAXES WITHHELD EXCEPT PHILADELPHIA INCOME TAX (From attached W-2’s, Box 19)

13

13

QUARTERLY PAYMENTS AND/OR LAST YEAR’S OVERPAYMENT CREDITED TO THIS YEAR

14

14

CREDITS FOR TAXES PAID TO PHILADELPHIA AND/OR STATES OTHER THAN PA (ATTACH SCH. G) AND/OR

0.00

15

15

CREDITS FOR CERTIFIED RESIDENTS OF THE HARRISBURG KEYSTONE OPPORTUNITY ZONE (KOZ)

TOTAL WITHHOLDINGS & PAYMENTS (Add Line 13, 14 and 15)

0.00

16

16

TAX BALANCE DUE (Subtract Line 16 from Line 12) PAYMENT NOT NECESSARY IF LESS THAN $1.00

17

17

0.00

INTEREST & PENALTY (See Instructions)

18

18

PLACE SOCIAL SECURITY

TOTAL BALANCE DUE (Add Lines 17 and 18) Make check payable to “CTCB”

19

19

0.00

NUMBER ON CHECK

OVERPAYMENT (Subtract Line 12 from Line 16) IF LESS THAN ZERO, ENTER ZERO

20

20

0.00

OVERPAYMENT TO BE REFUNDED

21

21

0.00

DIRECT DEPOSIT

ROUTING NO.

ACCOUNT NO.

SELECT ONE

CHECKING

SAVINGS

INFORMATION

OVERPAYMENT TO BE CREDITED TO NEXT YEAR’S TAX

22

22

DO NOT USE THIS LINE

23

23

TYPE OR PRINT INFORMATION BELOW. IF PREPRINTED, CHECK FOR ACCURACY AND MAKE CORRECTIONS WHERE NECESSARY.

YOUR RESIDENT MUNICIPALITY

DAYTIME PHONE NUMBER

(TOWNSHIP, BOROUGH, OR CITY)

SELECT YOUR MUNICIPALITY

YOUR NAME

YOUR CTCB ACCOUNT

YOUR SOCIAL SECURITY NUMBER

(LAST, FIRST, MI)

NUMBER (IF KNOWN)

IF YES, COMPLETE SCHEDULE P

HAVE YOU MOVED FROM THE

YES

HOME

BEGINNING OF THE TAX FILING

ON BACK OF “BUREAU’S” COPY

ADDRESS

YEAR TO PRESENT?

OF RETURN

NO

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS,

AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT AND COMPLETE.

YOUR SIGNATURE

DATE

YOUR OCCUPATION

X

2/16/2006

PAID PREPARER’S NAME (PLEASE PRINT)

FIRM’S NAME (OR ENTER “S.E.” IF SELF EMPLOYED)

PAID PREPARER’S PHONE NUMBER

Bureau's Copy

1

1