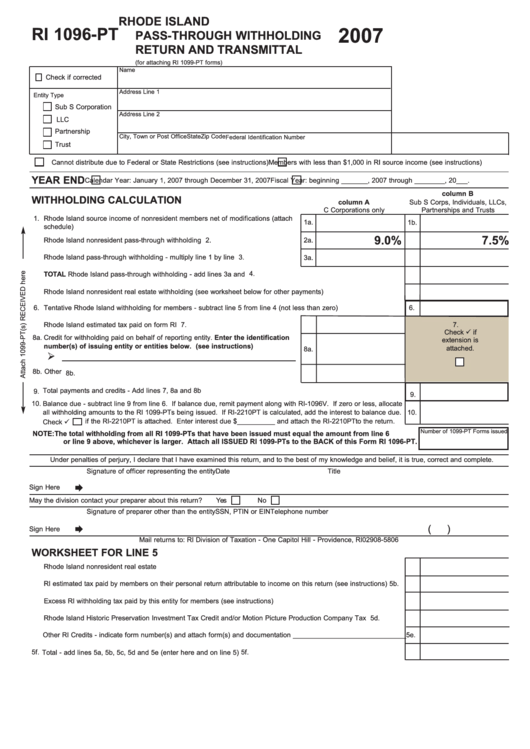

Form Ri 1096-Pt - Rhode Island Pass-Through Withholding Return And Transmittal - 2007

ADVERTISEMENT

RHODE ISLAND

RI 1096-PT

2007

PASS-THROUGH WITHHOLDING

RETURN AND TRANSMITTAL

(for attaching RI 1099-PT forms)

Name

Check if corrected

Address Line 1

Entity Type

Sub S Corporation

Address Line 2

LLC

Partnership

City, Town or Post Office

State

Zip Code

Federal Identification Number

Trust

Cannot distribute due to Federal or State Restrictions (see instructions)

Members with less than $1,000 in RI source income (see instructions)

YEAR END

Calendar Year: January 1, 2007 through December 31, 2007

Fiscal Year: beginning _______, 2007 through ________, 20___.

column B

WITHHOLDING CALCULATION

column A

Sub S Corps, Individuals, LLCs,

C Corporations only

Partnerships and Trusts

1.

Rhode Island source income of nonresident members net of modifications (attach

1a.

1b.

schedule)........................................................................................................................

9.0%

7.5%

2.

Rhode Island nonresident pass-through withholding rate..............................................

2a.

2b.

3.

Rhode Island pass-through withholding - multiply line 1 by line 2.................................

3b.

3a.

4.

4.

TOTAL Rhode Island pass-through withholding - add lines 3a and 3b.................................................................................

5.

Rhode Island nonresident real estate withholding (see worksheet below for other payments).............................................

5.

6.

Tentative Rhode Island withholding for members - subtract line 5 from line 4 (not less than zero)......................................

6.

7.

Rhode Island estimated tax paid on form RI 1096PT-ES...............................................

7.

Check

if

8a.

Credit for withholding paid on behalf of reporting entity. Enter the identification

extension is

number(s) of issuing entity or entities below. (see instructions) .........................

8a.

attached.

8b. Other payments.............................................................................................................. 8b.

Total payments and credits - Add lines 7, 8a and 8b ............................................................................................................

9.

9.

10.

Balance due - subtract line 9 from line 6. If balance due, remit payment along with RI-1096V. If zero or less, allocate

all withholding amounts to the RI 1099-PTs being issued. If RI-2210PT is calculated, add the interest to balance due.

10.

if the RI-2210PT is attached. Enter interest due $__________ and attach the RI-2210PT to the return.

Check

Number of 1099-PT Forms issued

NOTE:

The total withholding from all RI 1099-PTs that have been issued must equal the amount from line 6

or line 9 above, whichever is larger. Attach all ISSUED RI 1099-PTs to the BACK of this Form RI 1096- PT.

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of officer representing the entity

Title

Date

Sign Here

May the division contact your preparer about this return?

Yes

No

Signature of preparer other than the entity

SSN, PTIN or EIN

Telephone number

(

)

Sign Here

Mail returns to: RI Division of Taxation - One Capitol Hill - Providence, RI 02908-5806

WORKSHEET FOR LINE 5

5a.

Rhode Island nonresident real estate withholding.................................................................................................................

5a.

5b.

RI estimated tax paid by members on their personal return attributable to income on this return (see instructions)...........

5b.

5c.

Excess RI withholding tax paid by this entity for members (see instructions).......................................................................

5c.

5d.

Rhode Island Historic Preservation Investment Tax Credit and/or Motion Picture Production Company Tax Credit............

5d.

5e.

5e.

Other RI Credits - indicate form number(s) and attach form(s) and documentation ______________________________

5f. Total - add lines 5a, 5b, 5c, 5d and 5e (enter here and on line 5)......................................................................................... 5f.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1