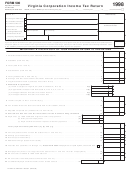

page 2

Name

FE or TR No.

ADDITIONS (See instructions)

.00

27.

Net income (loss) from rental real estate activities

27.

.00

28.

Net income (loss) from other rental activities

28.

29.

Portfolio Income (loss) (see instructions):

.00

a. Interest income

29a.

.00

b. Dividend income

29b.

.00

c. Royalty income

29c.

.00

d. Net short-term capital gain (loss) (from Schedule D )

29d.

.00

e. Net long-term capital gain (loss) (from Schedule D )

29e.

.00

f. Other portfolio income

29f.

.00

30.

Net gain (loss) under Section 1231

30.

.00

Other income from U.S. Schedule K

31.

31.

.00

32.

State or local taxes measured by income

32.

.00

33.

Other miscellaneous additions (attach schedule)

33.

.00

34.

Total additions. Add lines 27 through 33. Enter here and on line 6

34.

SUBTRACTIONS (See instructions)

.00

35.

Income (loss) from other partnerships, S corp. and fiduciaries included in ordinary income

35.

.00

36.

Other miscellaneous subtractions (attach schedule)

36.

.00

37.

Total subtractions. Add lines 35 and 36. Enter here and on line 8

37.

MICHIGAN ALLOCATED INCOME OR (LOSS)

.00

38.

Guaranteed payments to participants for services performed in Michigan

38.

.00

39.

Income attributable to other Michigan partnerships, S corporations or fiduciaries

39.

.00

Net Michigan capital gains (losses) (from Schedule D)

40.

40.

.00

41.

Other Michigan allocated income (see instructions)

41.

42.

Total Michigan allocated income or loss

.00

Add lines 38 through 41. Enter here and on line 12

42.

EXEMPTION ALLOWANCE

.00

43.

Number of participants included in this agreement

43.

.00

44.

Line 43 times $2,800 exemption allowance

44.

.00

45.

Total Michigan income from line 13

45.

.00

46.

Total distributive income (line 8 of the worksheet)

46.

47.

Percent of income attributable to Michigan. Divide line 45 by line 46

%

(May not exceed 100%.)

47.

48.

Apportioned exemption allowance. Multiply line 44 by the percentage on line 47

.00

Enter here and on line 17

48.

KEOGH OR HR 10 SUBTRACTIONS

.00

49.

Keogh or HR-10 subtractions for participants (attach schedule)

49.

%

50.

Enter the percent of income attributable to Michigan from line 47

50.

51.

Keogh or HR-10 subtractions attributable to Michigan

.00

Multiply line 49 by the percentage on line 50. Enter here and on line 18

51.

807 1998

1

1 2

2 3

3