Form 2009 Il-1120-X - Amended Corporation Income And Replacement Tax Return

ADVERTISEMENT

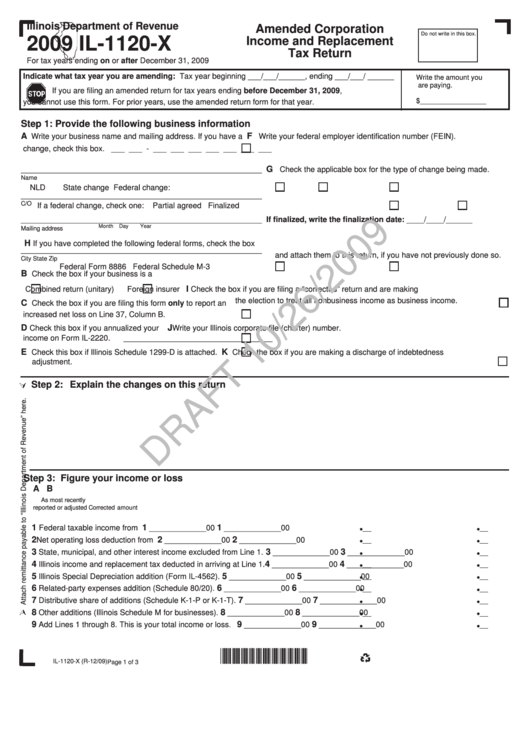

Illinois Department of Revenue

Amended Corporation

Do not write in this box.

2009 IL-1120-X

Income and Replacement

Tax Return

For tax years ending on or after December 31, 2009

Indicate what tax year you are amending: Tax year beginning ___/___/______, ending ___/___/ ______

Write the amount you

are paying.

If you are filing an amended return for tax years ending before December 31, 2009,

$_________________

you cannot use this form. For prior years, use the amended return form for that year.

Step 1: Provide the following business information

A

F

Write your business name and mailing address. If you have a

Write your federal employer identification number (FEIN).

change, check this box.

___ ___ - ___ ___ ___ ___ ___ ___ ___

G

_______________________________________________________

Check the applicable box for the type of change being made.

Name

NLD

State change

Federal change:

_______________________________________________________

C/O

If a federal change, check one:

Partial agreed

Finalized

_______________________________________________________

If finalized, write the finalization date: ____/____/______

Month

Day

Year

Mailing address

H

If you have completed the following federal forms, check the box

_______________________________________________________

and attach them to this return, if you have not previously done so.

City

State

Zip

Federal Form 8886

Federal Schedule M-3

B

Check the box if your business is a

I

Combined return (unitary)

Foreign insurer

Check the box if you are filing a “corrected” return and are making

the election to treat all nonbusiness income as business income.

C

Check the box if you are filing this form only to report an

increased net loss on Line 37, Column B.

D

J

Check this box if you annualized your

Write your Illinois corporate file (charter) number.

income on Form IL-2220.

__________________________________

E

K

Check this box if Illinois Schedule 1299-D is attached.

Check the box if you are making a discharge of indebtedness

adjustment.

Step 2: Explain the changes on this return

Step 3: Figure your income or loss

A

B

As most recently

reported or adjusted

Corrected amount

1

1

1

Federal taxable income from U.S. Form 1120.

_____________ 00

_____________ 00

2

2

2

Net operating loss deduction from U.S. Form 1120.

_____________ 00

_____________ 00

3

3

3

State, municipal, and other interest income excluded from Line 1.

_____________ 00

_____________ 00

4

4

4

Illinois income and replacement tax deducted in arriving at Line 1.

_____________ 00

_____________ 00

5

5

5

Illinois Special Depreciation addition (Form IL-4562).

_____________ 00

_____________ 00

6

6

6

Related-party expenses addition (Schedule 80/20).

_____________ 00

_____________ 00

7

7

7

Distributive share of additions (Schedule K-1-P or K-1-T).

_____________ 00

_____________ 00

8

8

8

Other additions (Illinois Schedule M for businesses)

_____________ 00

_____________ 00

.

9

9

9

Add Lines 1 through 8. This is your total income or loss

_____________ 00

_____________ 00

.

*933101110*

IL-1120-X (R-12/09)

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3