Form 511tx - Credit For Tax Paid To Another State - 2005

ADVERTISEMENT

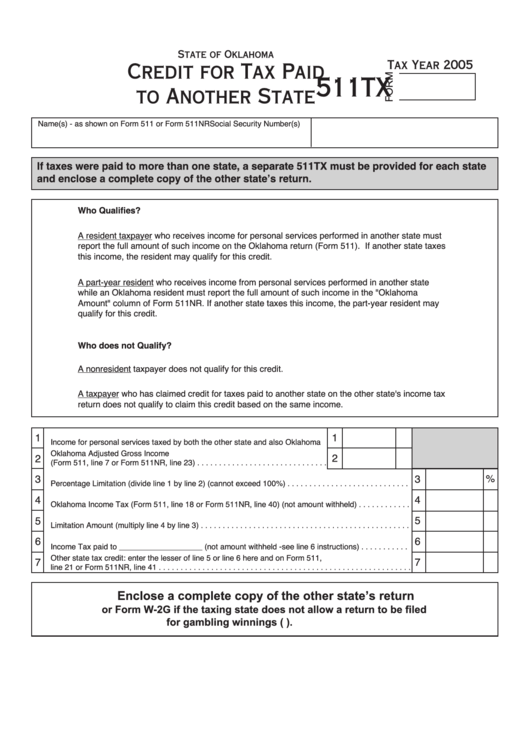

State of Oklahoma

Tax Year 2005

Credit for Tax Paid

511TX

to Another State

Name(s) - as shown on Form 511 or Form 511NR

Social Security Number(s)

If taxes were paid to more than one state, a separate 511TX must be provided for each state

and enclose a complete copy of the other state’s return.

Who Qualifies?

A resident taxpayer who receives income for personal services performed in another state must

report the full amount of such income on the Oklahoma return (Form 511). If another state taxes

this income, the resident may qualify for this credit.

A part-year resident who receives income from personal services performed in another state

while an Oklahoma resident must report the full amount of such income in the "Oklahoma

Amount" column of Form 511NR. If another state taxes this income, the part-year resident may

qualify for this credit.

Who does not Qualify?

A nonresident taxpayer does not qualify for this credit.

A taxpayer who has claimed credit for taxes paid to another state on the other state's income tax

return does not qualify to claim this credit based on the same income.

1

1

Income for personal services taxed by both the other state and also Oklahoma

Oklahoma Adjusted Gross Income

2

2

(Form 511, line 7 or Form 511NR, line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

3

3

Percentage Limitation (divide line 1 by line 2) (cannot exceed 100%) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4

Oklahoma Income Tax (Form 511, line 18 or Form 511NR, line 40) (not amount withheld) . . . . . . . . . . . .

5

5

Limitation Amount (multiply line 4 by line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

Income Tax paid to ___________________ (not amount withheld -see line 6 instructions) . . . . . . . . . . .

Other state tax credit: enter the lesser of line 5 or line 6 here and on Form 511,

7

7

line 21 or Form 511NR, line 41 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Enclose a complete copy of the other state’s return

or Form W-2G if the taxing state does not allow a return to be filed

for gambling winnings (i.e. Mississippi).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1