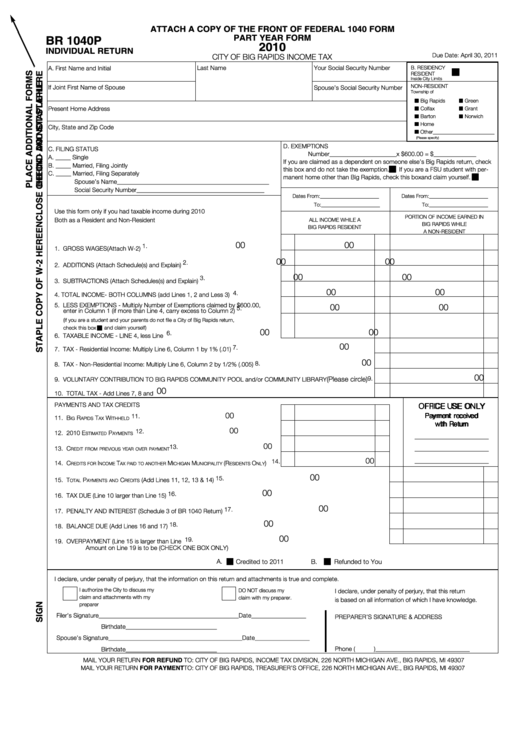

Form Br 1040p - Individual Return - City Of Big Rapids Income Tax - 2010

ADVERTISEMENT

ATTACH A COPY OF THE FRONT OF FEDERAL 1040 FORM

PART YEAR FORM

BR 1040P

2010

INDIVIDUAL RETURN

Due Date: April 30, 2011

CITY OF BIG RAPIDS INCOME TAX

Last Name

Your Social Security Number

A. First Name and Initial

B. RESIDENCY

I I

RESIDENT

Inside City Limits

NON-RESIDENT

If Joint First Name of Spouse

Spouse’s Social Security Number

Township of

Big Rapids

Green

I I

I I

Present Home Address

Colfax

Grant

I I

I I

Barton

Norwich

I I

I I

Home

I I

City, State and Zip Code

Other_______________________

I I

(Please specify)

D. EXEMPTIONS

C. FILING STATUS

Number______________________x $600.00 = $______________

A. _____ Single

If you are claimed as a dependent on someone else’s Big Rapids return, check

B. _____ Married, Filing Jointly

this box and do not take the exemption.

I I

If you are a FSU student with per-

C. _____ Married, Filing Separately

manent home other than Big Rapids, check this box and claim yourself.

I I

Spouse’s Name__________________________________________________

Social Security Number __________________________________________

Dates From:______________________

Dates From:______________________

To:______________________

To:______________________

Use this form only if you had taxable income during 2010

PORTION OF INCOME EARNED IN

Both as a Resident and Non-Resident

ALL INCOME WHILE A

BIG RAPIDS WHILE

BIG RAPIDS RESIDENT

A NON-RESIDENT

00

00

1.

1. GROSS WAGES (Attach W-2)................................................................................

00

00

2.

2. ADDITIONS (Attach Schedule(s) and Explain) ........................................................

00

00

3.

3. SUBTRACTIONS (Attach Schedules(s) and Explain) ..............................................

00

00

4.

4. TOTAL INCOME - BOTH COLUMNS (add Lines 1, 2 and Less 3) ..........................

5. LESS EXEMPTIONS - Multiply Number of Exemptions claimed by $600.00,

00

00

5.

enter in Column 1 (if more than Line 4, carry excess to Column 2) ........................

(if you are a student and your parents do not file a City of Big Rapids return,

check this box

and claim yourself)

I I

00

00

6.

6. TAXABLE INCOME - LINE 4, less Line 5 ................................................................

00

7.

7. TAX - Residential Income: Multiply Line 6, Column 1 by 1% (.01) ..................................................................................

00

8.

8. TAX - Non-Residential Income: Multiply Line 6, Column 2 by 1/2% (.005) ....................................................................

00

(Please circle)

9.

9. VOLUNTARY CONTRIBUTION TO BIG RAPIDS COMMUNITY POOL and/or COMMUNITY LIBRARY

00

10. TOTAL TAX - Add Lines 7, 8 and 9 ............................................................................................................................

10.

PAYMENTS AND TAX CREDITS

O O F F F F I I C C E E U U S S E E O O N N L L Y Y

00

P P a a y y m m e e n n t t r r e e c c e e i i v v e e d d

11.

11. B

R

T

W

......................................................................................

IG

APIDS

AX

ITHHELD

w w i i t t h h R R e e t t u u r r n n

00

12.

12. 2010 E

P

....................................................................................

STIMATED

AYMENTS

_____________________

00

13.

_____________________

13. C

..............................................................

REDIT FROM PREVIOUS YEAR OVER PAYMENT

00

_____________________

14.

14. C

I

T

M

M

(R

O

) ..........

REDITS FOR

NCOME

AX PAID TO ANOTHER

ICHIGAN

UNICIPALITY

ESIDENTS

NLY

00

(Add Lines 11, 12, 13 & 14) ...................................................................................................... 15.

15. T

P

C

OTAL

AYMENTS AND

REDITS

00

16. TAX DUE (Line 10 larger than Line 15) .................................................................................................................................. 16.

00

17. PENALTY AND INTEREST (Schedule 3 of BR 1040 Return) .................................................................................................. 17.

00

18. BALANCE DUE (Add Lines 16 and 17) .................................................................................................................................. 18.

00

19. OVERPAYMENT (Line 15 is larger than Line 10 .................................................................................................................... 19.

Amount on Line 19 is to be (CHECK ONE BOX ONLY)

A.

Credited to 2011

B.

Refunded to You

I I

I I

I declare, under penalty of perjury, that the information on this return and attachments is true and complete.

I authorize the City to discuss my

DO NOT discuss my

I declare, under penalty of perjury, that this return

claim and attachments with my

claim with my preparer.

is based on all information of which I have knowledge.

preparer

Filer’s Signature ______________________________________________ Date __________________

PREPARER’S SIGNATURE & ADDRESS

Birthdate ______________________________

Spouse’s Signature ____________________________________________ Date __________________

Phone (

)_______________________________

Birthdate ______________________________

MAIL YOUR RETURN FOR REFUND TO: CITY OF BIG RAPIDS, INCOME TAX DIVISION, 226 NORTH MICHIGAN AVE., BIG RAPIDS, MI 49307

MAIL YOUR RETURN FOR PAYMENT TO: CITY OF BIG RAPIDS, TREASURER’S OFFICE, 226 NORTH MICHIGAN AVE., BIG RAPIDS, MI 49307

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2