Va Form 8454p - Paid Tax Preparer Hardship Waiver Request - Virginia Department Of Taxation

ADVERTISEMENT

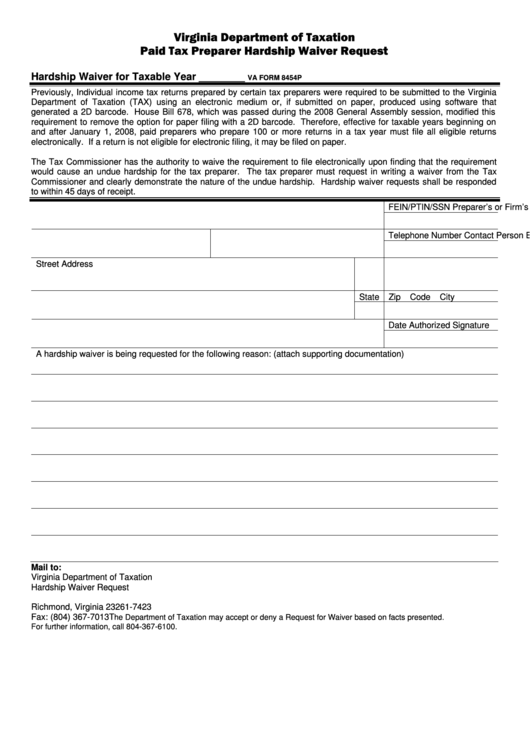

Virginia Department of Taxation

Paid Tax Preparer Hardship Waiver Request

Hardship Waiver for Taxable Year ________

VA FORM 8454P

Previously, Individual income tax returns prepared by certain tax preparers were required to be submitted to the Virginia

Department of Taxation (TAX) using an electronic medium or, if submitted on paper, produced using software that

generated a 2D barcode. House Bill 678, which was passed during the 2008 General Assembly session, modified this

requirement to remove the option for paper filing with a 2D barcode. Therefore, effective for taxable years beginning on

and after January 1, 2008, paid preparers who prepare 100 or more returns in a tax year must file all eligible returns

electronically. If a return is not eligible for electronic filing, it may be filed on paper.

The Tax Commissioner has the authority to waive the requirement to file electronically upon finding that the requirement

would cause an undue hardship for the tax preparer. The tax preparer must request in writing a waiver from the Tax

Commissioner and clearly demonstrate the nature of the undue hardship. Hardship waiver requests shall be responded

to within 45 days of receipt.

Preparer’s or Firm’s Name

FEIN/PTIN/SSN

Contact Person

E-MAIL Address

Telephone Number

Street Address

City

State

Zip Code

Authorized Signature

Date

A hardship waiver is being requested for the following reason: (attach supporting documentation)

Mail to:

Virginia Department of Taxation

Hardship Waiver Request

P.O. Box 27423

Richmond, Virginia 23261-7423

Fax: (804) 367-7013T

he Department of Taxation may accept or deny a Request for Waiver based on facts presented.

For further information, call 804-367-6100.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1