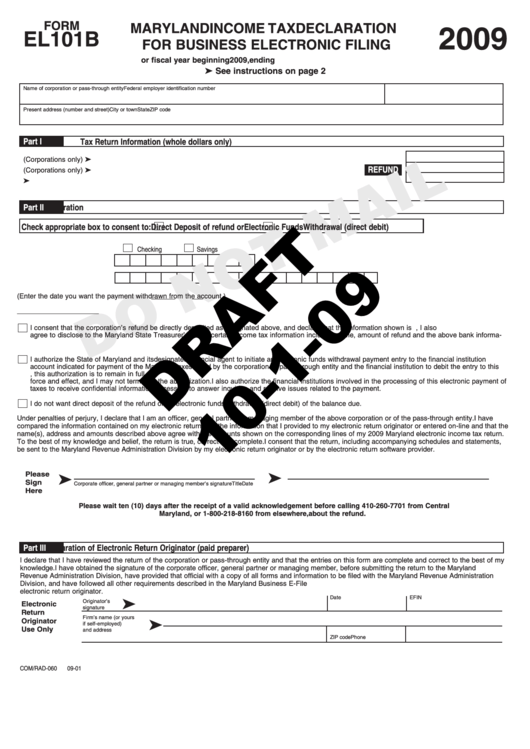

Form El101b Draft - Maryland Income Tax Declaration For Business Electronic Filing - 2009

ADVERTISEMENT

FORM

MARYLAND INCOME TAX DECLARATION

2009

EL101B

FOR BUSINESS ELECTRONIC FILING

or fiscal year beginning

2009, ending

® See instructions on page 2

Name of corporation or pass-through entity

Federal employer identification number

Present address (number and street)

City or town

State

ZIP code

Part I

Tax Return Information (whole dollars only)

1. Amount of overpayment to be applied to 2010 estimated tax (Corporations only)............................................................ ®

REFUND

2. Amount of overpayment to be refunded (Corporations only)...................................................................... ®

3. Total amount due................................................................................................................................................................ ®

Part II

Declaration

Check appropriate box to consent to:

Direct Deposit of refund or

Electronic Funds Withdrawal (direct debit)

4a.

Type of account

Checking

Savings

4b.

Routing number

4c.

Account number

4d.

Direct debit settlement date

/

/

(Enter the date you want the payment withdrawn from the account.)

Direct debit amount _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

4e.

I consent that the corporation’s refund be directly deposited as designated above, and declare that the information shown is correct. By consenting, I also

agree to disclose to the Maryland State Treasurer’s Office certain income tax information including name, amount of refund and the above bank informa-

tion. This disclosure is necessary to effect direct deposit.

I authorize the State of Maryland and its designated financial agent to initiate an electronic funds withdrawal payment entry to the financial institution

account indicated for payment of the Maryland taxes owed by the corporation or pass through entity and the financial institution to debit the entry to this

account. Upon confirmation of consent during the filing of the of the corporation or pass through entity state return, this authorization is to remain in full

force and effect, and I may not terminate the authorization. I also authorize the financial institutions involved in the processing of this electronic payment of

taxes to receive confidential information necessary to answer inquiries and resolve issues related to the payment.

I do not want direct deposit of the refund or an electronic funds withdrawal (direct debit) of the balance due.

Under penalties of perjury, I declare that I am an officer, general partner or managing member of the above corporation or of the pass-through entity. I have

compared the information contained on my electronic return with the information that I provided to my electronic return originator or entered on-line and that the

name(s), address and amounts described above agree with the amounts shown on the corresponding lines of my 2009 Maryland electronic income tax return.

To the best of my knowledge and belief, the return is true, correct and complete. I consent that the return, including accompanying schedules and statements,

be sent to the Maryland Revenue Administration Division by my electronic return originator or by the electronic return software provider.

Please

®

®

Sign

Corporate officer, general partner or managing member’s signature

Title

Date

Here

Please wait ten (10) days after the receipt of a valid acknowledgement before calling 410-260-7701 from Central

Maryland, or 1-800-218-8160 from elsewhere, about the refund.

Part III

Declaration of Electronic Return Originator (paid preparer)

I declare that I have reviewed the return of the corporation or pass-through entity and that the entries on this form are complete and correct to the best of my

knowledge. I have obtained the signature of the corporate officer, general partner or managing member, before submitting the return to the Maryland

Revenue Administration Division, have provided that official with a copy of all forms and information to be filed with the Maryland Revenue Administration

Division, and have followed all other requirements described in the Maryland Business E-File Handbook. This declaration is to be retained at the site of the

electronic return originator.

Date

EFIN

Originator’s

®

Electronic

signature

Return

Firm’s name (or yours

Originator

®

if self-employed)

Use Only

and address

ZIP code

Phone

COM/RAD-060

09-01

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2