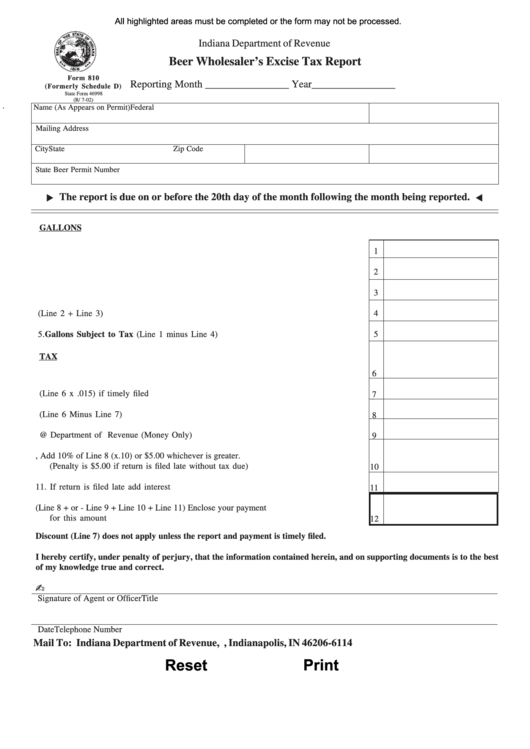

All highlighted areas must be completed or the form may not be processed.

Indiana Department of Revenue

Beer Wholesaler’s Excise Tax Report

Form 810

Reporting Month ________________ Year________________

(Formerly Schedule D)

State Form 46998

(R/ 7-02)

Name (As Appears on Permit)

Federal I.D. Number

Mailing Address

City

State

Zip Code

State Beer Permit Number

The report is due on or before the 20th day of the month following the month being reported.

GALLONS

1. Total Gallons Received per Schedule B-1 ..........................................................................

1

2. Deduct total Gallons per Schedule B-2 ..............................................................................

2

3. Deduct total Gallons per Schedule B-3 ..............................................................................

3

4. Total Deductions (Line 2 + Line 3) ...................................................................................

4

5. Gallons Subject to Tax (Line 1 minus Line 4)...................................................................

5

TAX

6. Multiply Line 5 by Tax Rate of .115 ..................................................................................

6

7. Discount (Line 6 x .015) if timely filed .............................................................................

7

8. Amount Due (Line 6 Minus Line 7) ..................................................................................

8

9. Adjustments Auth. @ Department of Revenue (Money Only) ..........................................

9

10. If return is filed after due date, Add 10% of Line 8 (x.10) or $5.00 whichever is greater.

(Penalty is $5.00 if return is filed late without tax due) .....................................................

10

11. If return is filed late add interest .......................................................................................

11

12. Total Amount Due (Line 8 + or - Line 9 + Line 10 + Line 11) Enclose your payment

for this amount .................................................................................................................

12

Discount (Line 7) does not apply unless the report and payment is timely filed.

I hereby certify, under penalty of perjury, that the information contained herein, and on supporting documents is to the best

of my knowledge true and correct.

Signature of Agent or Officer

Title

Date

Telephone Number

Mail To: Indiana Department of Revenue, P.O. Box 6114, Indianapolis, IN 46206-6114

Print

Reset

1

1