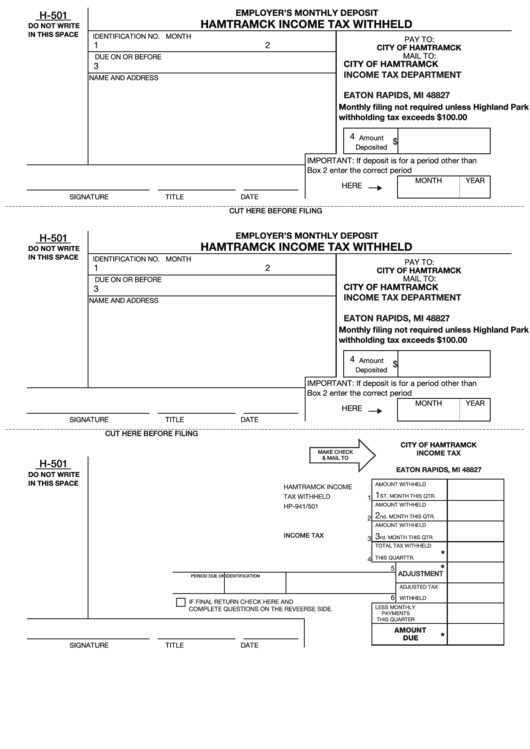

Form H-501 - Hamtramck Income Tax Withheld

ADVERTISEMENT

EMPLOYER’S MONTHLY DEPOSIT

H-501

HAMTRAMCK INCOME TAX WITHHELD

DO NOT WRITE

IN THIS SPACE

IDENTIFICATION NO.

MONTH

PAY TO:

1

2

CITY OF HAMTRAMCK

MAIL TO:

DUE ON OR BEFORE

CITY OF HAMTRAMCK

3

INCOME TAX DEPARTMENT

NAME AND ADDRESS

P.O. BOX 209

EATON RAPIDS, MI 48827

Monthly filing not required unless Highland Park

withholding tax exceeds $100.00

4

Amount

$

Deposited

IMPORTANT: If deposit is for a period other than

Box 2 enter the correct period

MONTH

YEAR

HERE

SIGNATURE

TITLE

DATE

CUT HERE BEFORE FILING

EMPLOYER’S MONTHLY DEPOSIT

H-501

HAMTRAMCK INCOME TAX WITHHELD

DO NOT WRITE

IN THIS SPACE

IDENTIFICATION NO.

MONTH

PAY TO:

1

2

CITY OF HAMTRAMCK

MAIL TO:

DUE ON OR BEFORE

CITY OF HAMTRAMCK

3

INCOME TAX DEPARTMENT

NAME AND ADDRESS

P.O. BOX 209

EATON RAPIDS, MI 48827

Monthly filing not required unless Highland Park

withholding tax exceeds $100.00

4

Amount

$

Deposited

IMPORTANT: If deposit is for a period other than

Box 2 enter the correct period

MONTH

YEAR

HERE

SIGNATURE

TITLE

DATE

CUT HERE BEFORE FILING

CITY OF HAMTRAMCK

INCOME TAX

MAKE CHECK

& MAIL TO

P.O. BOX 209

H-501

EATON RAPIDS, MI 48827

DO NOT WRITE

IN THIS SPACE

AMOUNT WITHHELD

HAMTRAMCK INCOME

1

TAX WITHHELD

ST. MONTH THIS QTR.

1

AMOUNT WITHHELD

HP-941/501

2

nd. MONTH THIS QTR.

2

AMOUNT WITHHELD

3

INCOME TAX

rd. MONTH THIS QTR.

3

TOTAL TAX WITHHELD

*

THIS QUARTTR.

4

*

5

ADJUSTMENT

PERIOD

DUE ON

IDENTIFICATION

ADJUSTED TAX

6

WITHHELD

IF FINAL RETURN CHECK HERE AND

LESS MONTHLY

COMPLETE QUESTIONS ON THE REVEERSE SIDE.

PAYMENTS

THIS QUARTER

AMOUNT

*

DUE

SIGNATURE

TITLE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2