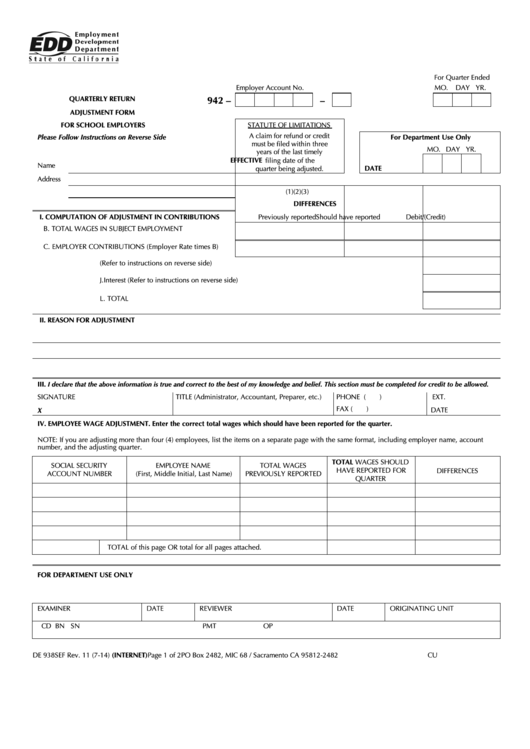

For Quarter Ended

Employer Account No.

MO. DAY YR.

942 –

–

QUARTERLY RETURN

ADJUSTMENT FORM

FOR SCHOOL EMPLOYERS

STATUTE OF LIMITATIONS

A claim for refund or credit

Please Follow Instructions on Reverse Side

For Department Use Only

must be filed within three

MO. DAY YR.

years of the last timely

EFFECTIVE

filing date of the

Name

DATE

quarter being adjusted.

Address

(1)

(2)

(3)

DIFFERENCES

I. COMPUTATION OF ADJUSTMENT IN CONTRIBUTIONS

Previously reported

Should have reported

Debit/(Credit)

B. TOTAL WAGES IN SUBJECT EMPLOYMENT

C. EMPLOYER CONTRIBUTIONS (Employer Rate times B)

I. Penalty (Refer to instructions on reverse side) .......................................................................................

J. Interest (Refer to instructions on reverse side) ........................................................................................

L. TOTAL ...............................................................................................................................................

II. REASON FOR ADJUSTMENT

III.

I declare that the above information is true and correct to the best of my knowledge and belief. This section must be completed for credit to be allowed.

SIGNATURE

TITLE (Administrator, Accountant, Preparer, etc.)

PHONE (

)

EXT.

FAX

(

)

DATE

X

IV. EMPLOYEE WAGE ADJUSTMENT. Enter the correct total wages which should have been reported for the quarter.

NOTE: If you are adjusting more than four (4) employees, list the items on a separate page with the same format, including employer name, account

number, and the adjusting quarter.

TOTAL WAGES SHOULD

SOCIAL SECURITY

EMPLOYEE NAME

TOTAL WAGES

HAVE REPORTED FOR

DIFFERENCES

ACCOUNT NUMBER

(First, Middle Initial, Last Name)

PREVIOUSLY REPORTED

QUARTER

TOTAL of this page OR total for all pages attached.

FOR DEPARTMENT USE ONLY

EXAMINER

DATE

REVIEWER

DATE

ORIGINATING UNIT

CD

BN

SN

PMT

OP

DE 938SEF Rev. 11 (7-14) (INTERNET)

Page 1 of 2

PO Box 2482, MIC 68 / Sacramento CA 95812-2482

CU

1

1