Resale Certificate Form - Maine Revenue Services

ADVERTISEMENT

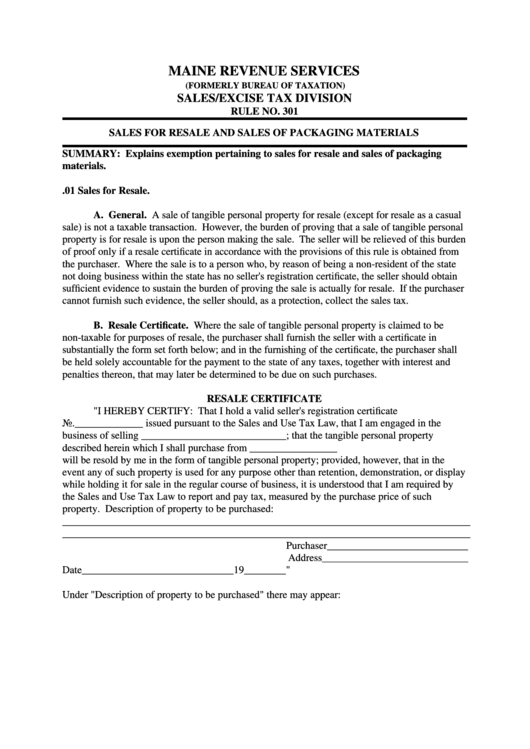

MAINE REVENUE SERVICES

(FORMERLY BUREAU OF TAXATION)

SALES/EXCISE TAX DIVISION

RULE NO. 301

SALES FOR RESALE AND SALES OF PACKAGING MATERIALS

SUMMARY: Explains exemption pertaining to sales for resale and sales of packaging

materials.

.01 Sales for Resale.

A. General. A sale of tangible personal property for resale (except for resale as a casual

sale) is not a taxable transaction. However, the burden of proving that a sale of tangible personal

property is for resale is upon the person making the sale. The seller will be relieved of this burden

of proof only if a resale certificate in accordance with the provisions of this rule is obtained from

the purchaser. Where the sale is to a person who, by reason of being a non-resident of the state

not doing business within the state has no seller's registration certificate, the seller should obtain

sufficient evidence to sustain the burden of proving the sale is actually for resale. If the purchaser

cannot furnish such evidence, the seller should, as a protection, collect the sales tax.

B. Resale Certificate. Where the sale of tangible personal property is claimed to be

non-taxable for purposes of resale, the purchaser shall furnish the seller with a certificate in

substantially the form set forth below; and in the furnishing of the certificate, the purchaser shall

be held solely accountable for the payment to the state of any taxes, together with interest and

penalties thereon, that may later be determined to be due on such purchases.

RESALE CERTIFICATE

"I HEREBY CERTIFY: That I hold a valid seller's registration certificate

No._____________ issued pursuant to the Sales and Use Tax Law, that I am engaged in the

business of selling ____________________________; that the tangible personal property

described herein which I shall purchase from _________________

will be resold by me in the form of tangible personal property; provided, however, that in the

event any of such property is used for any purpose other than retention, demonstration, or display

while holding it for sale in the regular course of business, it is understood that I am required by

the Sales and Use Tax Law to report and pay tax, measured by the purchase price of such

property. Description of property to be purchased:

______________________________________________________________________________

______________________________________________________________________________

Purchaser___________________________

Address____________________________

Date_____________________________19________"

Under "Description of property to be purchased" there may appear:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3