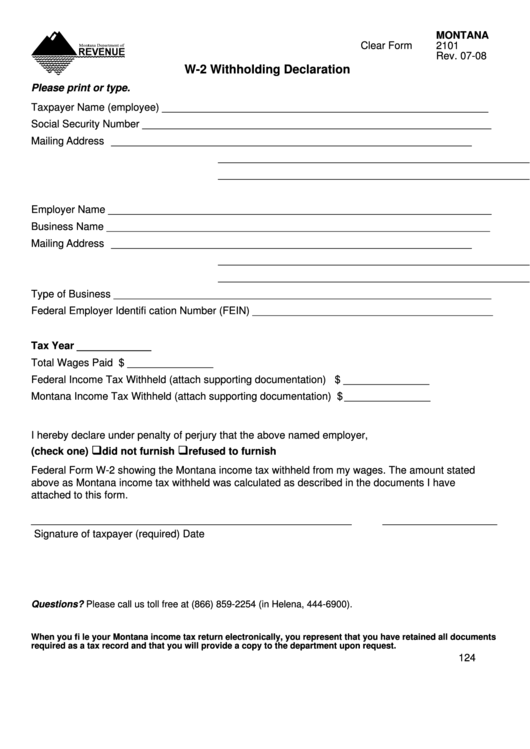

MONTANA

Clear Form

2101

Rev. 07-08

W-2 Withholding Declaration

Please print or type.

Taxpayer Name (employee) _________________________________________________________

Social Security Number _____________________________________________________________

Mailing Address

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

Employer Name ___________________________________________________________________

Business Name ___________________________________________________________________

Mailing Address

_______________________________________________________________

_______________________________________________________________

_______________________________________________________________

Type of Business __________________________________________________________________

Federal Employer Identifi cation Number (FEIN) __________________________________________

Tax Year _____________

Total Wages Paid ................................................................................................... $ _______________

Federal Income Tax Withheld (attach supporting documentation) ....................... $ _______________

Montana Income Tax Withheld (attach supporting documentation) ...................... $ _______________

I hereby declare under penalty of perjury that the above named employer,

(check one)

did not furnish

refused to furnish

Federal Form W-2 showing the Montana income tax withheld from my wages. The amount stated

above as Montana income tax withheld was calculated as described in the documents I have

attached to this form.

________________________________________________________

____________________

Signature of taxpayer (required)

Date

Questions? Please call us toll free at (866) 859-2254 (in Helena, 444-6900).

When you fi le your Montana income tax return electronically, you represent that you have retained all documents

required as a tax record and that you will provide a copy to the department upon request.

124

1

1