City Of Hickman, Kentucky-Net Profit License Return Form

ADVERTISEMENT

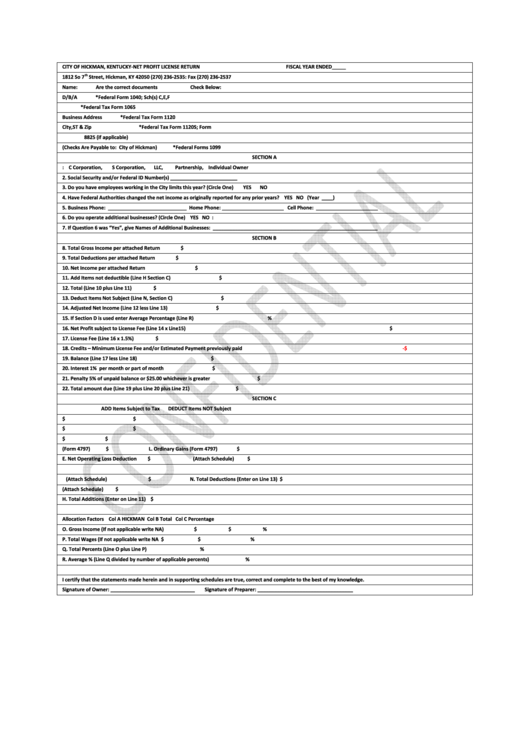

CITY OF HICKMAN, KENTUCKY-NET PROFIT LICENSE RETURN

FISCAL YEAR ENDED_____

th

1812 So 7

Street, Hickman, KY 42050 (270) 236-2535: Fax (270) 236-2537

Name:

Are the correct documents

Check Below:

D/B/A

*Federal Form 1040; Sch(s) C,E,F

*Federal Tax Form 1065

Business Address

*Federal Tax Form 1120

City,ST & Zip

*Federal Tax Form 1120S; Form

8825 (if applicable)

(Checks Are Payable to: City of Hickman)

*Federal Forms 1099

SECTION A

1.Circle Appropriate Form of Business: C Corporation,

S Corporation,

LLC,

Partnership, Individual Owner

2. Social Security and/or Federal ID Number(s) ________________________

3. Do you have employees working in the City limits this year? (Circle One)

YES

NO

4. Have Federal Authorities changed the net income as originally reported for any prior years? YES NO (Year ____)

5. Business Phone: ____________________________ Home Phone: ______________________ Cell Phone: ______________________

6. Do you operate additional businesses? (Circle One) YES NO :

7. If Question 6 was “Yes”, give Names of Additional Businesses: ___________________________________________________________

SECTION B

8. Total Gross Income per attached Return

$

9. Total Deductions per attached Return

$

10. Net Income per attached Return

$

11. Add Items not deductible (Line H Section C)

$

12. Total (Line 10 plus Line 11)

$

13. Deduct Items Not Subject (Line N, Section C)

$

14. Adjusted Net Income (Line 12 less Line 13)

$

15. If Section D is used enter Average Percentage (Line R)

%

16. Net Profit subject to License Fee (Line 14 x Line15)

$

17. License Fee (Line 16 x 1.5%)

$

18. Credits – Minimum License Fee and/or Estimated Payment previously paid

-$

19. Balance (Line 17 less Line 18)

$

20. Interest 1% per month or part of month

$

21. Penalty 5% of unpaid balance or $25.00 whichever is greater

$

22. Total amount due (Line 19 plus Line 20 plus Line 21)

$

SECTION C

ADD Items Subject to Tax

DEDUCT Items NOT Subject

A.State or Local Taxes

$

I.Interest Income

$

B.License Fee Under this Ordinance

$

J.Dividends

$

C.Net Loss from Capital Assets

$

K.Net Gain from Capital Assets

$

D.Ordinary Losses (Form 4797)

$

L. Ordinary Gains (Form 4797)

$

E. Net Operating Loss Deduction

$

M.Other Items (Attach Schedule)

$

F.Partners Guaranteed Payments

(Attach Schedule)

$

N. Total Deductions (Enter on Line 13) $

G.Other Items (Attach Schedule)

$

H. Total Additions (Enter on Line 11) $

Allocation Factors

Col A HICKMAN

Col B Total

Col C Percentage

O. Gross Income (If not applicable write NA)

$

$

%

P. Total Wages (If not applicable write NA

$

$

%

Q. Total Percents (Line O plus Line P)

%

R. Average % (Line Q divided by number of applicable percents)

%

I certify that the statements made herein and in supporting schedules are true, correct and complete to the best of my knowledge.

Signature of Owner: ______________________________

Signature of Preparer: __________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1