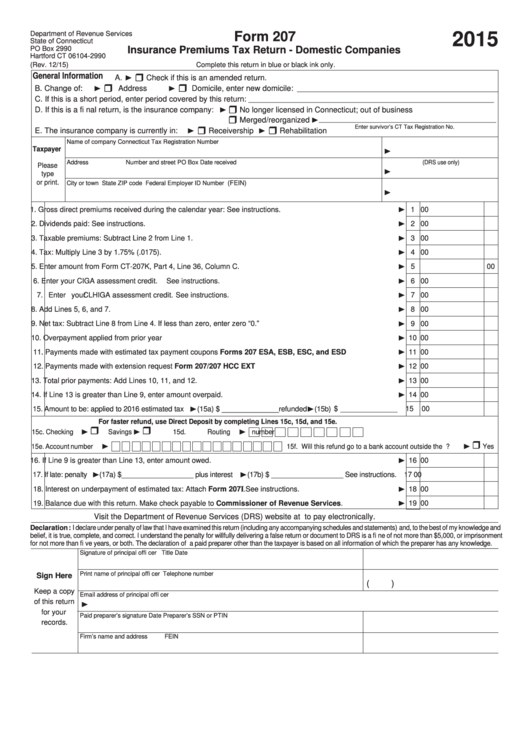

Form 207 - Insurance Premiums Tax Return - Domestic Companies - 2015

ADVERTISEMENT

Department of Revenue Services

Form 207

2015

State of Connecticut

PO Box 2990

Insurance Premiums Tax Return - Domestic Companies

Hartford CT 06104-2990

(Rev. 12/15)

Complete this return in blue or black ink only.

General Information

A.

Check if this is an amended return.

B. Change of:

Address

Domicile, enter new domicile:

___________________________________________________________

C. If this is a short period, enter period covered by this return:

________________________________________________________________________

D. If this is a fi nal return, is the insurance company:

No longer licensed in Connecticut; out of business

Merged/reorganized

____________________________________________________

Enter survivor’s CT Tax Registration No.

E. The insurance company is currently in:

Receivership

Rehabilitation

Name of company

Connecticut Tax Registration Number

Taxpayer

Address

Number and street

PO Box

Date received (DRS use only)

Please

type

or print.

City or town

State

ZIP code

Federal Employer ID Number

(FEIN)

1. Gross direct premiums received during the calendar year: See instructions. .................................................

1

00

2. Dividends paid: See instructions. ....................................................................................................................

2

00

3. Taxable premiums: Subtract Line 2 from Line 1. .............................................................................................

3

00

4. Tax: Multiply Line 3 by 1.75% (.0175). ............................................................................................................

4

00

5

5. Enter amount from Form CT-207K, Part 4, Line 36, Column C. ......................................................................

00

6. Enter your CIGA assessment credit. See instructions. ....................................................................................

6

00

7. Enter your CLHIGA assessment credit. See instructions. ...............................................................................

7

00

8. Add Lines 5, 6, and 7. ......................................................................................................................................

8

00

9. Net tax: Subtract Line 8 from Line 4. If less than zero, enter zero “0.” ...........................................................

9

00

10. Overpayment applied from prior year ..............................................................................................................

10

00

11. Payments made with estimated tax payment coupons Forms 207 ESA, ESB, ESC, and ESD ....................

11

00

12. Payments made with extension request Form 207/207 HCC EXT .................................................................

12

00

13. Total prior payments: Add Lines 10, 11, and 12. .............................................................................................

13

00

14. If Line 13 is greater than Line 9, enter amount overpaid. ................................................................................

14

00

15. Amount to be: applied to 2016 estimated tax

(15a) $ ______________refunded

(15b) $ ______________

15

00

For faster refund, use Direct Deposit by completing Lines 15c, 15d, and 15e.

15c. Checking

Savings

15d. Routing number

15e. Account number

15f. Will this refund go to a bank account outside the U.S.?

Yes

16. If Line 9 is greater than Line 13, enter amount owed. .....................................................................................

16

00

17. If late: penalty

(17a) $__________________ plus interest

(17b) $ __________________ See instructions.

17

00

18. Interest on underpayment of estimated tax: Attach Form 207

I

. See instructions. ..........................................

18

00

19. Balance due with this return. Make check payable to Commissioner of Revenue Services. ......................

19

00

Visit the Department of Revenue Services (DRS) website at to pay electronically.

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and

belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fi ne of not more than $5,000, or imprisonment

for not more than fi ve years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature of principal offi cer

Title

Date

Print name of principal offi cer

Telephone number

Sign Here

(

)

Keep a copy

Email address of principal offi cer

of this return

for your

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

records.

Firm’s name and address

FEIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2