Rental/lease Tax Return Form - City Of Gardendale, Alabama

ADVERTISEMENT

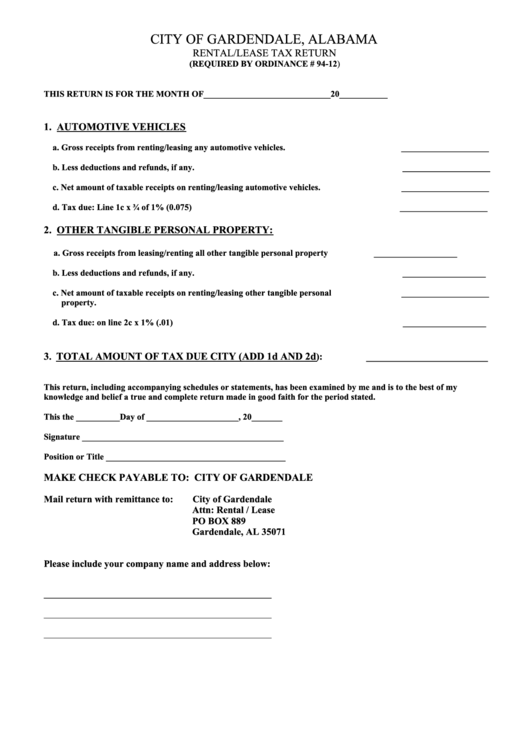

CITY OF GARDENDALE, ALABAMA

RENTAL/LEASE TAX RETURN

(REQUIRED BY ORDINANCE # 94-12)

THIS RETURN IS FOR THE MONTH OF_____________________________20___________

1. AUTOMOTIVE VEHICLES

a. Gross receipts from renting/leasing any automotive vehicles.

____________________

b. Less deductions and refunds, if any.

____________________

c. Net amount of taxable receipts on renting/leasing automotive vehicles.

____________________

d. Tax due: Line 1c x ¾ of 1% (0.075)

____________________

2. OTHER TANGIBLE PERSONAL PROPERTY:

a. Gross receipts from leasing/renting all other tangible personal property

___________________

b. Less deductions and refunds, if any.

___________________

c. Net amount of taxable receipts on renting/leasing other tangible personal

____________________

property.

d. Tax due: on line 2c x 1% (.01)

___________________

3

TOTAL AMOUNT OF TAX DUE CITY (ADD 1d AND 2d

.

):

_________________________

This return, including accompanying schedules or statements, has been examined by me and is to the best of my

knowledge and belief a true and complete return made in good faith for the period stated.

This the __________Day of _____________________, 20_______

Signature ______________________________________________

Position or Title _________________________________________

MAKE CHECK PAYABLE TO: CITY OF GARDENDALE

Mail return with remittance to:

City of Gardendale

Attn: Rental / Lease

PO BOX 889

Gardendale, AL 35071

Please include your company name and address below:

____________________________________________________

____________________________________________________

____________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1