Delaware Form 300 (Draft) - Delaware Partnership Return - 2006

ADVERTISEMENT

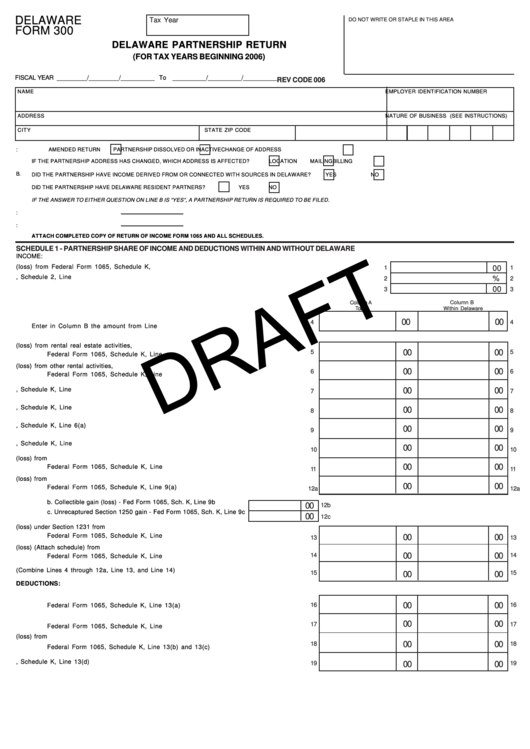

DELAWARE

Tax Year

DO NOT WRITE OR STAPLE IN THIS AREA

FORM 300

DELAWARE PARTNERSHIP RETURN

(FOR TAX YEARS BEGINNING 2006)

FISCAL YEAR _________/_________/__________ To __________/__________/__________

REV CODE 006

NAME

EMPLOYER IDENTIFICATION NUMBER

ADDRESS

NATURE OF BUSINESS (SEE INSTRUCTIONS)

CITY

STATE

ZIP CODE

A.

CHECK APPLICABLE BOX:

AMENDED RETURN

PARTNERSHIP DISSOLVED OR INACTIVE

CHANGE OF ADDRESS

IF THE PARTNERSHIP ADDRESS HAS CHANGED, WHICH ADDRESS IS AFFECTED?

LOCATION

MAILING

BILLING

B.

DID THE PARTNERSHIP HAVE INCOME DERIVED FROM OR CONNECTED WITH SOURCES IN DELAWARE?

YES

NO

DID THE PARTNERSHIP HAVE DELAWARE RESIDENT PARTNERS?

YES

NO

IF THE ANSWER TO EITHER QUESTION ON LINE B IS “YES”, A PARTNERSHIP RETURN IS REQUIRED TO BE FILED.

C.

TOTAL NUMBER OF PARTNERS:

D.

YEAR PARTNERSHIP FORMED:

ATTACH COMPLETED COPY OF U.S. PARTNERSHIP RETURN OF INCOME FORM 1065 AND ALL SCHEDULES.

SCHEDULE 1 - PARTNERSHIP SHARE OF INCOME AND DEDUCTIONS WITHIN AND WITHOUT DELAWARE

INCOME:

1.

Ordinary income (loss) from Federal Form 1065, Schedule K, Line1......................................................................

1

00

1

2.

Apportionment percentage from Delaware Form 300, Schedule 2, Line 16...............................................................

%

2

2

3.

Ordinary income apportioned to Delaware. Multiply Line 1 times Line 2...................................................................

00

3

3

Column A

Column B

Total

Within Delaware

4.

Enter in Column A the amount from Line 1.....................................................................

00

00

4

4

Enter in Column B the amount from Line 3.....................................................................

5.

Net income (loss) from rental real estate activities,

00

00

5

5

Federal Form 1065, Schedule K, Line 2..................................................................

6.

Net income (loss) from other rental activities,

00

00

6

6

Federal Form 1065, Schedule K, Line 3c.................................................................

7.

Guaranteed payments from Federal Form 1065, Schedule K, Line 4...................................

00

00

7

7

8.

Interest income from Federal Form 1065, Schedule K, Line 5............................................

00

00

8

8

9.

Dividend income from Federal Form 1065, Schedule K, Line 6(a).......................................

00

00

9

9

10.

Royalty income from Federal Form 1065, Schedule K, Line 7............................................

00

00

10

10

11.

Net short term capital gain (loss) from

00

00

Federal Form 1065, Schedule K, Line 8...................................................................

11

11

12a. Net long term capital gain (loss) from

00

00

Federal Form 1065, Schedule K, Line 9(a)...............................................................

12a

12a

b. Collectible gain (loss) - Fed Form 1065, Sch. K, Line 9b

00

12b

c. Unrecaptured Section 1250 gain - Fed Form 1065, Sch. K, Line 9c

00

12c

13.

Net gain (loss) under Section 1231 from

Federal Form 1065, Schedule K, Line 10..................................................................

00

00

13

13

14.

Other income (loss) (Attach schedule) from

14

00

00

14

Federal Form 1065, Schedule K, Line 11..................................................................

15.

Total Income (Combine Lines 4 through 12a, Line 13, and Line 14).......................................

15

00

00

15

DEDUCTIONS:

16.

Charitable contributions from

00

00

16

16

Federal Form 1065, Schedule K, Line 13(a)..............................................................

17.

Section 179 expense deduction from

00

00

17

17

Federal Form 1065, Schedule K, Line 12..................................................................

18.

Expenses related to portfolio income (loss) from

00

00

18

18

Federal Form 1065, Schedule K, Line 13(b) and 13(c).................................................

19.

Other deductions from Federal Form 1065, Schedule K, Line 13(d).......................................

19

00

00

19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3