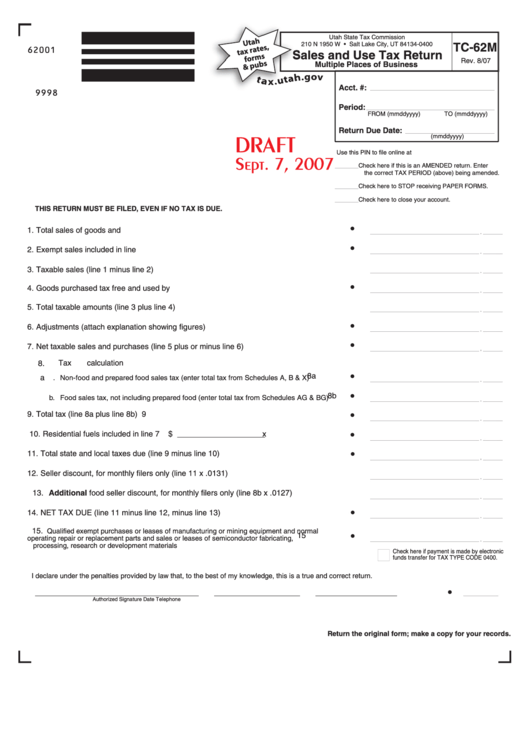

Form Tc-62m Draft - Sales And Use Tax Return Multiple Places Of Business

ADVERTISEMENT

Utah State Tax Commission

210 N 1950 W • Salt Lake City, UT 84134-0400

TC-62M

62001

Sales and Use Tax Return

Rev. 8/07

Multiple Places of Business

Acct. #:

9998

Period:

FROM (mmddyyyy)

TO (mmddyyyy)

Return Due Date:

DRAFT

(mmddyyyy)

Use this PIN to file online at utah.gov/salestax

Sept. 7, 2007

__ __

Check here if this is an AMENDED return. Enter

the correct TAX PERIOD (above) being amended.

__ __

Check here to STOP receiving PAPER FORMS.

__ __

Check here to close your account.

THIS RETURN MUST BE FILED, EVEN IF NO TAX IS DUE.

1. Total sales of goods and services ....................................................................................

1

2. Exempt sales included in line 1 ........................................................................................

2

3. Taxable sales (line 1 minus line 2)....................................................................................

3

4. Goods purchased tax free and used by you .....................................................................

4

5. Total taxable amounts (line 3 plus line 4) .........................................................................

5

6. Adjustments (attach explanation showing figures) ...........................................................

6

7. Net taxable sales and purchases (line 5 plus or minus line 6) .........................................

7

Tax calculation

8.

8a

a

.................

. Non-food and prepared food sales tax (enter total tax from Schedules A, B & X)

8b

........

b. Food sales tax, not including prepared food (enter total tax from Schedules AG & BG)

9. Total tax (line 8a plus line 8b) ...........................................................................................

9

10. Residential fuels included in line 7

$_ _ _ _ _ _ _ _ __ _ _ x .0265 ........................

10

11. Total state and local taxes due (line 9 minus line 10) .......................................................

11

12. Seller discount, for monthly filers only (line 11 x .0131) ...................................................

12

13. Additional food seller discount, for monthly filers only (line 8b x .0127) .........................

13

14. NET TAX DUE (line 11 minus line 12, minus line 13) .......................................................

14

15.

Qualified exempt purchases or leases of manufacturing or mining equipment and normal

15

operating repair or replacement parts and sales or leases of semiconductor fabricating, ...............

processing, research or development materials

Check here if payment is made by electronic

funds transfer for TAX TYPE CODE 0400.

I declare under the penalties provided by law that, to the best of my knowledge, this is a true and correct return.

Authorized Signature

Date

Telephone

Return the original form; make a copy for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2