Form St-810 - New York State And Local Quarterly Sales And Use Tax Return For Part-Quarterly (Monthly) Filers

ADVERTISEMENT

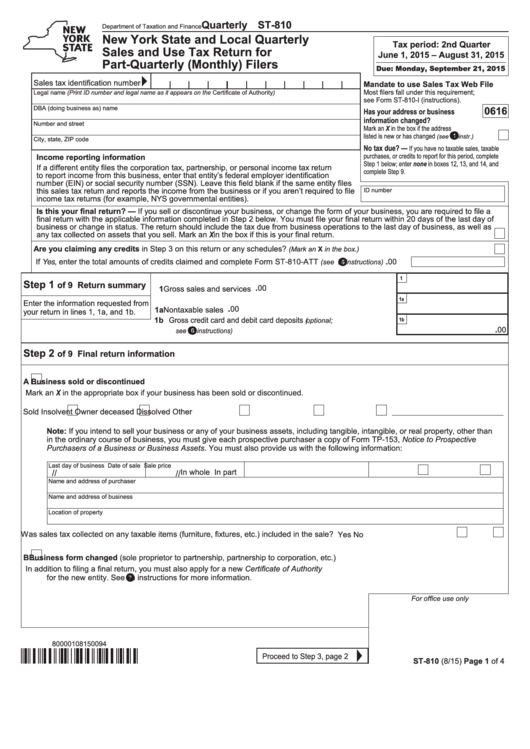

Quarterly ST-810

Department of Taxation and Finance

New York State and Local Quarterly

Tax period: 2nd Quarter

Sales and Use Tax Return for

June 1, 2015 – August 31, 2015

Part-Quarterly (Monthly) Filers

Due: Monday, September 21, 2015

Sales tax identification number

Mandate to use Sales Tax Web File

Most filers fall under this requirement;

Legal name (Print ID number and legal name as it appears on the Certificate of Authority)

see Form ST-810-I (instructions).

DBA (doing business as) name

0616

Has your address or business

information changed?

Number and street

Mark an X in the box if the address

listed is new or has changed

........

(see

in instr.)

City, state, ZIP code

No tax due? —

If you have no taxable sales, taxable

purchases, or credits to report for this period, complete

Income reporting information

Step 1 below; enter none in boxes 12, 13, and 14, and

If a different entity files the corporation tax, partnership, or personal income tax return

complete Step 9.

to report income from this business, enter that entity’s federal employer identification

number (EIN) or social security number (SSN). Leave this field blank if the same entity files

this sales tax return and reports the income from the business or if you aren’t required to file

ID number

income tax returns (for example, NYS governmental entities). .................................................

Is this your final return? — If you sell or discontinue your business, or change the form of your business, you are required to file a

final return with the applicable information completed in Step 2 below. You must file your final return within 20 days of the last day of

business or change in status. The return should include the tax due from business operations to the last day of business, as well as

any tax collected on assets that you sell. Mark an X in the box if this is your final return. .......................................................................

Are you claiming any credits in Step 3 on this return or any schedules?

............................................................

(Mark an X in the box.)

.

If Yes, enter the total amounts of credits claimed and complete Form ST-810-ATT

.....

00

(see

in instructions)

1

Step 1

of 9 Return summary

.

00

1 Gross sales and services ...............................................................

1a

Enter the information requested from

.

00

1a Nontaxable sales ...........................................................................

your return in lines 1, 1a, and 1b.

1b Gross credit card and debit card deposits

(optional;

1b

.

00

.........................................................................

see

in instructions)

Step 2

of 9 Final return information

A

Business sold or discontinued

Mark an X in the appropriate box if your business has been sold or discontinued.

Sold

Insolvent

Owner deceased

Dissolved

Other

Note: If you intend to sell your business or any of your business assets, including tangible, intangible, or real property, other than

in the ordinary course of business, you must give each prospective purchaser a copy of Form TP-153, Notice to Prospective

Purchasers of a Business or Business Assets. You must also provide us with the following information:

Last day of business

Date of sale

Sale price

In whole

In part

/

/

/

/

Name and address of purchaser

Name and address of business

Location of property

Was sales tax collected on any taxable items (furniture, fixtures, etc.) included in the sale? .................................... Yes

No

B

Business form changed (sole proprietor to partnership, partnership to corporation, etc.)

In addition to filing a final return, you must also apply for a new Certificate of Authority

for the new entity. See

in instructions for more information.

For office use only

80000108150094

Proceed to Step 3, page 2

ST-810 (8/15) Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4