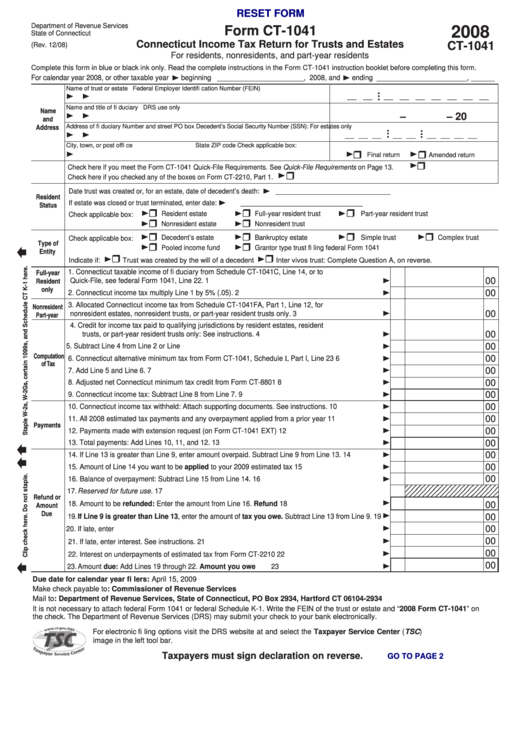

RESET FORM

Department of Revenue Services

Form CT-1041

2008

State of Connecticut

Connecticut Income Tax Return for Trusts and Estates

CT-1041

(Rev. 12/08)

For residents, nonresidents, and part-year residents

Complete this form in blue or black ink only. Read the complete instructions in the Form CT-1041 instruction booklet before completing this form

.

For calendar year 2008, or other taxable year

beginning ______________________, 2008, and

ending _______________________ , ______

Name of trust or estate

Federal Employer Identifi cation Number (FEIN)

•

__ __

__ __ __ __ __ __ __

• •

Name and title of fi duciary

DRS use only

Name

–

– 20

and

Address

Address of fi duciary

Number and street

PO box

Decedent’s Social Security Number (SSN): For estates only

•

•

__ __ __

__ __

__ __ __ __

•

•

•

•

City, town, or post offi ce

State

ZIP code

Check applicable box:

Final return

Amended return

Check here if you meet the Form CT-1041 Quick-File Requirements. See Quick-File Requirements on Page 13.

Check here if you checked any of the boxes on Form CT-2210, Part 1.

Date trust was created or, for an estate, date of decedent’s death:

_______________________________

Resident

If estate was closed or trust terminated, enter date:

_________________________________

Status

Resident estate

Full-year resident trust

Part-year resident trust

Check applicable box:

Nonresident estate

Nonresident trust

Decedent’s estate

Bankruptcy estate

Simple trust

Complex trust

Check applicable box:

Type of

Pooled income fund

Grantor type trust fi ling federal Form 1041

Entity

Indicate if:

Trust was created by the will of a decedent

Inter vivos trust: Complete Question A, on reverse.

Full-year

1. Connecticut taxable income of fi duciary from Schedule CT-1041C, Line 14, or to

Resident

00

Quick-File, see federal Form 1041, Line 22.

1

only

00

2. Connecticut income tax multiply Line 1 by 5% (.05).

2

3. Allocated Connecticut income tax from Schedule CT-1041FA, Part 1, Line 12, for

Nonresident

00

Part-year

nonresident estates, nonresident trusts, or part-year resident trusts only.

3

4. Credit for income tax paid to qualifying jurisdictions by resident estates, resident

00

trusts, or part-year resident trusts only: See instructions.

4

00

5. Subtract Line 4 from Line 2 or Line 3. See instructions.

5

Computation

00

6. Connecticut alternative minimum tax from Form CT-1041, Schedule I, Part I, Line 23

6

of Tax

00

7. Add Line 5 and Line 6.

7

00

8. Adjusted net Connecticut minimum tax credit from Form CT-8801

8

00

9. Connecticut income tax: Subtract Line 8 from Line 7.

9

00

10. Connecticut income tax withheld: Attach supporting documents. See instructions.

10

00

11. All 2008 estimated tax payments and any overpayment applied from a prior year

11

Payments

00

12. Payments made with extension request (on Form CT-1041 EXT)

12

00

13. Total payments: Add Lines 10, 11, and 12.

13

00

14. If Line 13 is greater than Line 9, enter amount overpaid. Subtract Line 9 from Line 13.

14

00

15. Amount of Line 14 you want to be applied to your 2009 estimated tax

15

00

16. Balance of overpayment: Subtract Line 15 from Line 14.

16

17. Reserved for future use.

17

Refund or

18. Amount to be refunded: Enter the amount from Line 16.

Refund

18

Amount

00

Due

19. If Line 9 is greater than Line 13, enter the amount of tax you owe. Subtract Line 13 from Line 9.

19

00

00

20. If late, enter penalty. See instructions.

20

00

21. If late, enter interest. See instructions.

21

00

22. Interest on underpayments of estimated tax from Form CT-2210

22

00

23. Amount due: Add Lines 19 through 22.

Amount you owe

23

Due date for calendar year fi lers: April 15, 2009

Make check payable to: Commissioner of Revenue Services

Mail to: Department of Revenue Services, State of Connecticut, PO Box 2934, Hartford CT 06104-2934

It is not necessary to attach federal Form 1041 or federal Schedule K-1. Write the FEIN of the trust or estate and “2008 Form CT-1041” on

the check. The Department of Revenue Services (DRS) may submit your check to your bank electronically.

For electronic fi ling options visit the DRS website at and select the Taxpayer Service Center (TSC)

image in the left tool bar.

Taxpayers must sign declaration on reverse.

GO TO PAGE 2

1

1 2

2