Form Brw-3 - Employer'S Annual Reconciliation Of Income Tax Withheld - City Of Big Rapids - 2011

ADVERTISEMENT

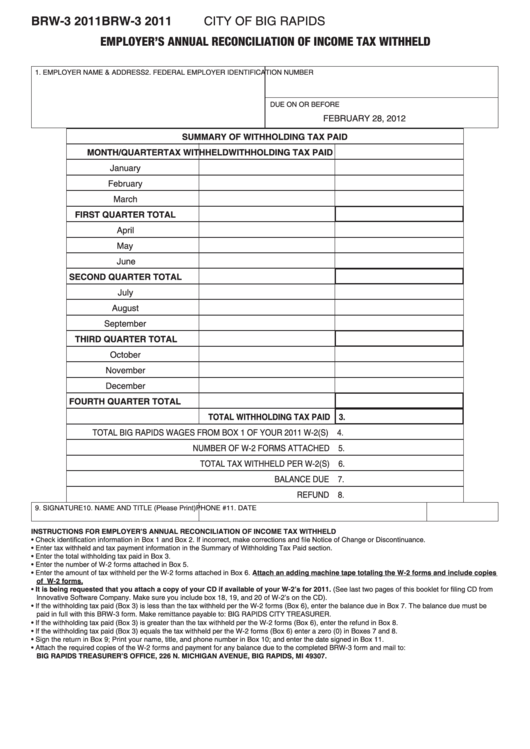

BRW-3 2011

CITY OF BIG RAPIDS

BRW-3 2011

EMPLOYER’S ANNUAL RECONCILIATION OF INCOME TAX WITHHELD

1. EMPLOYER NAME & ADDRESS

2. FEDERAL EMPLOYER IDENTIFICATION NUMBER

DUE ON OR BEFORE

FEBRUARY 28, 2012

SUMMARY OF WITHHOLDING TAX PAID

MONTH/QUARTER

TAX WITHHELD

WITHHOLDING TAX PAID

January

February

March

FIRST QUARTER TOTAL

April

May

June

SECOND QUARTER TOTAL

July

August

September

THIRD QUARTER TOTAL

October

November

December

FOURTH QUARTER TOTAL

TOTAL WITHHOLDING TAX PAID

3.

TOTAL BIG RAPIDS WAGES FROM BOX 1 OF YOUR 2011 W-2(S)

4.

NUMBER OF W-2 FORMS ATTACHED

5.

TOTAL TAX WITHHELD PER W-2(S)

6.

BALANCE DUE

7.

REFUND

8.

9. SIGNATURE

10. NAME AND TITLE (Please Print)

PHONE #

11. DATE

INSTRUCTIONS FOR EMPLOYER’S ANNUAL RECONCILIATION OF INCOME TAX WITHHELD

• Check identification information in Box 1 and Box 2. If incorrect, make corrections and file Notice of Change or Discontinuance.

• Enter tax withheld and tax payment information in the Summary of Withholding Tax Paid section.

• Enter the total withholding tax paid in Box 3.

• Enter the number of W-2 forms attached in Box 5.

• Enter the amount of tax withheld per the W-2 forms attached in Box 6. Attach an adding machine tape totaling the W-2 forms and include copies

of W-2 forms.

• It is being requested that you attach a copy of your CD if available of your W-2’s for 2011. (See last two pages of this booklet for filing CD from

Innovative Software Company. Make sure you include box 18, 19, and 20 of W-2’s on the CD).

• If the withholding tax paid (Box 3) is less than the tax withheld per the W-2 forms (Box 6), enter the balance due in Box 7. The balance due must be

paid in full with this BRW-3 form. Make remittance payable to: BIG RAPIDS CITY TREASURER.

• If the withholding tax paid (Box 3) is greater than the tax withheld per the W-2 forms (Box 6), enter the refund in Box 8.

• If the withholding tax paid (Box 3) equals the tax withheld per the W-2 forms (Box 6) enter a zero (0) in Boxes 7 and 8.

• Sign the return in Box 9; Print your name, title, and phone number in Box 10; and enter the date signed in Box 11.

• Attach the required copies of the W-2 forms and payment for any balance due to the completed BRW-3 form and mail to:

BIG RAPIDS TREASURER’S OFFICE, 226 N. MICHIGAN AVENUE, BIG RAPIDS, MI 49307.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1