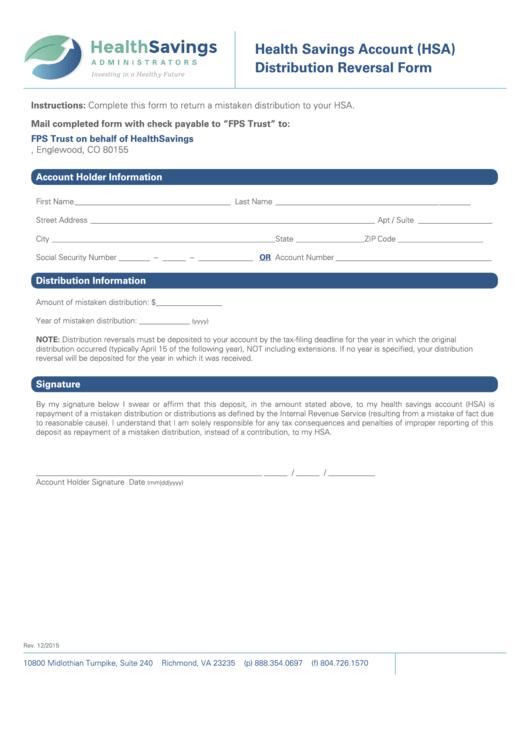

Health Savings Account (Hsa) Distribution Reversal Form

ADVERTISEMENT

Health Savings Account (HSA)

Distribution Reversal Form

Instructions: Complete this form to return a mistaken distribution to your HSA.

Mail completed form with check payable to “FPS Trust” to:

FPS Trust on behalf of HealthSavings

P .O. Box 3079, Englewood, CO 80155

Account Holder Information

Requirements

First Name ________________________________________ Last Name __________________________________________ M.I. ________

Street Address _________________________________________________________________________ Apt / Suite ___________________

City

State

ZIP Code

____________________________________________________________________

_____________________

__________________________

Social Security Number ________ – ______ – ______________

Account Number ________________________________________

OR

Distribution

InformationRequirements

Amount of mistaken distribution: $_________________

Year of mistaken distribution: _____________

(yyyy)

NOTE: Distribution reversals must be deposited to your account by the tax-filing deadline for the year in which the original

distribution occurred (typically April 15 of the following year), NOT including extensions. If no year is specified, your distribution

reversal will be deposited for the year in which it was received.

Signature

By my signature below I swear or affirm that this deposit, in the amount stated above, to my health savings account (HSA) is

repayment of a mistaken distribution or distributions as defined by the Internal Revenue Service (resulting from a mistake of fact due

to reasonable cause). I understand that I am solely responsible for any tax consequences and penalties of improper reporting of this

deposit as repayment of a mistaken distribution, instead of a contribution, to my HSA.

__________________________________________________________

______ / ______ / ____________

Account Holder Signature

Date

(mm|dd|yyyy)

Rev. 12/2015

10800 Midlothian Turnpike, Suite 240

Richmond, VA 23235

(p) 888.354.0697

(f) 804.726.1570

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1