Health Savings Account (Hsa) Death Distribution Request Form

ADVERTISEMENT

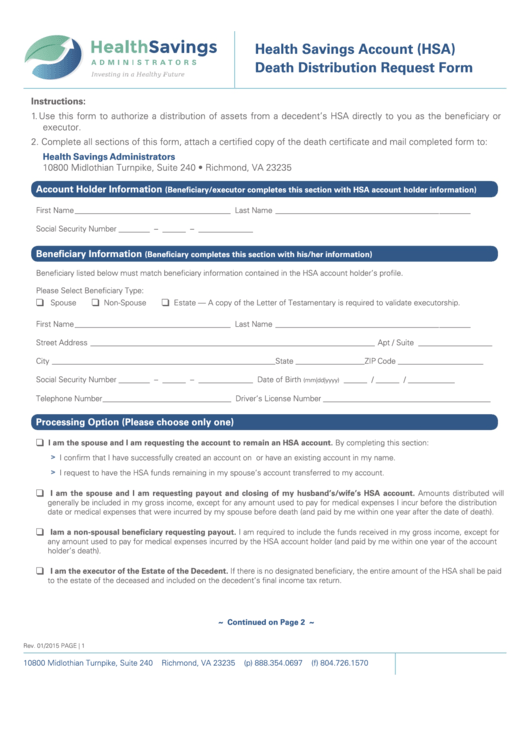

Health Savings Account (HSA)

Death Distribution Request Form

Instructions:

1. Use this form to authorize a distribution of assets from a decedent’s HSA directly to you as the beneficiary or

executor.

2. Complete all sections of this form, attach a certified copy of the death certificate and mail completed form to:

Health Savings Administrators

10800 Midlothian Turnpike, Suite 240 • Richmond, VA 23235

Account Holder Information

(Beneficiary/executor completes this section with HSA account holder

information)s

First Name ________________________________________ Last Name __________________________________________ M.I. ________

Social Security Number ________ – ______ – ______________

Beneficiary Information

(Beneficiary completes this section with his/her information)

Beneficiary listed below must match beneficiary information contained in the HSA account holder’s profile.

Please Select Beneficiary Type:

q

Spouse

q

Non-Spouse

q

Estate — A copy of the Letter of Testamentary is required to validate executorship.

First Name ________________________________________ Last Name __________________________________________ M.I. ________

Street Address _________________________________________________________________________ Apt / Suite ___________________

City

State

ZIP Code

____________________________________________________________________

_____________________

__________________________

Social Security Number ________ – ______ – ______________

Date of Birth

______ / ______ / ____________

(mm|dd|yyyy)

Telephone Number _________________________________ Driver’s License Number ___________________________________________

Processing Option (Please choose only one)

q

I am the spouse and I am requesting the account to remain an HSA account. By completing this section:

>

I confirm that I have successfully created an account on

or have an existing account in my name.

>

I request to have the HSA funds remaining in my spouse’s account transferred to my account.

q

I am the spouse and I am requesting payout and closing of my husband’s/wife’s HSA account. Amounts distributed will

generally be included in my gross income, except for any amount used to pay for medical expenses I incur before the distribution

date or medical expenses that were incurred by my spouse before death (and paid by me within one year after the date of death).

q

I am a non-spousal beneficiary requesting payout. I am required to include the funds received in my gross income, except for

any amount used to pay for medical expenses incurred by the HSA account holder (and paid by me within one year of the account

holder’s death).

q

I am the executor of the Estate of the Decedent. If there is no designated beneficiary, the entire amount of the HSA shall be paid

to the estate of the deceased and included on the decedent’s final income tax return.

~ Continued on Page 2 ~

Rev. 01/2015

PAGE | 1

10800 Midlothian Turnpike, Suite 240

Richmond, VA 23235

(p) 888.354.0697

(f) 804.726.1570

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2