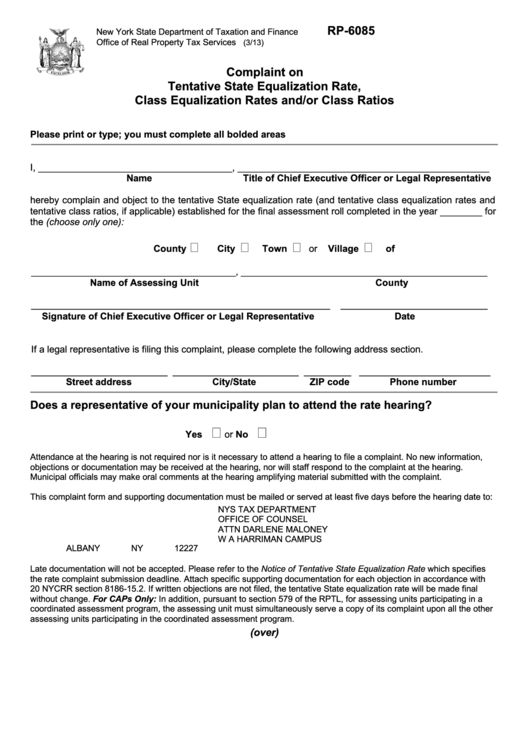

RP-6085

New York State Department of Taxation and Finance

Office of Real Property Tax Services

(3/13)

Complaint on

Tentative State Equalization Rate,

Class Equalization Rates and/or Class Ratios

Please print or type; you must complete all bolded areas

I, _____________________________________, ________________________________________________

Name

Title of Chief Executive Officer or Legal Representative

hereby complain and object to the tentative State equalization rate (and tentative class equalization rates and

tentative class ratios, if applicable) established for the final assessment roll completed in the year ________ for

the (choose only one):

County

City

Town

or

Village

of

_______________________________________, _______________________________________________

Name of Assessing Unit

County

_________________________________________________________

____________________________

Signature of Chief Executive Officer or Legal Representative

Date

If a legal representative is filing this complaint, please complete the following address section.

__________________________ ________________________ _________ _________________________

Street address

City/State

ZIP code

Phone number

Does a representative of your municipality plan to attend the rate hearing?

Yes

or

No

Attendance at the hearing is not required nor is it necessary to attend a hearing to file a complaint. No new information,

objections or documentation may be received at the hearing, nor will staff respond to the complaint at the hearing.

Municipal officials may make oral comments at the hearing amplifying material submitted with the complaint.

This complaint form and supporting documentation must be mailed or served at least five days before the hearing date to:

NYS TAX DEPARTMENT

OFFICE OF COUNSEL

ATTN DARLENE MALONEY

W A HARRIMAN CAMPUS

ALBANY NY 12227

Late documentation will not be accepted. Please refer to the Notice of Tentative State Equalization Rate which specifies

the rate complaint submission deadline. Attach specific supporting documentation for each objection in accordance with

20 NYCRR section 8186-15.2. If written objections are not filed, the tentative State equalization rate will be made final

without change. For CAPs Only: In addition, pursuant to section 579 of the RPTL, for assessing units participating in a

coordinated assessment program, the assessing unit must simultaneously serve a copy of its complaint upon all the other

assessing units participating in the coordinated assessment program.

(over)

1

1 2

2