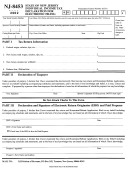

NJ-1040EZ (2003) Page 2

EARNED INCOME TAX CREDIT SCHEDULE

You may be eligible for the New Jersey Earned Income Tax Credit if you claimed the Federal Earned Income Credit for 2003, your gross income on Line 16, Form NJ-1040EZ is $20,000 or less, and your

filing status for New Jersey is the same as your filing status on your Federal income tax return. Complete this schedule to see if you are eligible. You are not eligible for the New Jersey Earned Income

Tax Credit if your filing status is single or married, filing separate return or if you answer “No” to question 1 below. See instructions.

1. Did you file a 2003 Federal Schedule EIC on which you

3. Enter amount of Federal Earned Income Credit from your

,

listed at least one “qualifying child”?.............................................

Yes

No

2003 Federal Form 1040 or 1040A ..................................................

2. Fill in oval if you had the IRS figure your Federal Earned Income Credit

4. Enter 20% of amount on Line 3 here and on Page 1, Line 28 .....................

GUBERNATORIAL ELECTIONS FUND

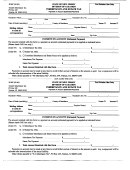

HOMESTEAD REBATE APPLICATION

(If you fill in the Yes oval(s) it will not increase your tax or reduce

your refund)

Do you wish to designate $1 of your taxes for this fund?

Yes

No

1. Enter the GROSS INCOME you reported on Line

,

1

If joint return, does your spouse wish to designate $1?

Yes

No

16, Form NJ-1040EZ...............................................

2. Enter your New Jersey address on December 31, 2003, if different from address on Page 1.

DEDUCTIONS FROM OVERPAYMENT

,

Street Address _________________________________________ Municipality ____________________

1. Credit to your 2004 tax ..................................................................

2. N.J. Endangered

3. Fill in your residency status during 2003

HOMEOWNER

TENANT

Wildlife Fund....................................

$10

$20

Other

4. If you indicated “Homeowner” on Line 3, enter the block and lot number of the residence for

3. N.J. Children’s Trust Fund

ENTER

which the rebate is claimed.

to Prevent Child Abuse ...................

$10

$20

Other

AMOUNT

4. N.J. Vietnam

Block

Veterans’ Memorial Fund................

$10

$20

Other

OF

5. N.J. Breast Cancer

Research Fund................................

$10

$20

Other

CONTRIBUTION

Lot

Qualifier

6. U.S.S. New Jersey

5. If homeowner, enter the total 2003 property

Educational Museum Fund.............

$10

$20

Other

,

taxes you (and your spouse) paid on your

5

7. Other Designated Contribution

principal residence in New Jersey during 2003 ......

0

(See instruction page 26)................

$10

$20

Other

6. If tenant, enter the total rent you (and your

8. Total Deductions From Overpayment.

,

,

spouse) paid on your principal residence in New

6

(Add Lines 1 through 7) Enter here and on Page 1, Line 32

Jersey during 2003..................................................

Division

1

2

3

4

5

6

7

Use

Under penalties of perjury, I declare that I have examined this income tax return and homestead rebate application, including accompanying schedules and

Pay amount on Line 30 in full.

statements, and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than taxpayer, this declaration is based

Write social security number(s) on

check or money order and make

on all information of which the preparer has any knowledge.

payable to:

STATE OF NEW JERSEY - TGI

Mail your check or money order with

Your Signature

Date

Spouse’s Signature (if filing jointly, BOTH must sign)

your NJ-1040EZ-V payment voucher

and your return to:

NJ Division of Taxation

Revenue Processing Center

I authorize the Division of Taxation to discuss my return and enclosures with my preparer (below)

If you do not need forms mailed to you next year, fill in

PO Box 641

Trenton, NJ 08646-0641

IF REFUND:

NJ Division of Taxation

Revenue Processing Center

PO Box 640

Paid Preparer’s Signature

Federal Identification Number

Trenton, NJ 08646-0640

You may also pay by e-check or credit

card. For more information go to:

Firm’s Name

Federal Employer Identification Number

1

1 2

2