Form Ct-1na - Connecticut Nonresident Income Tax Agreement

ADVERTISEMENT

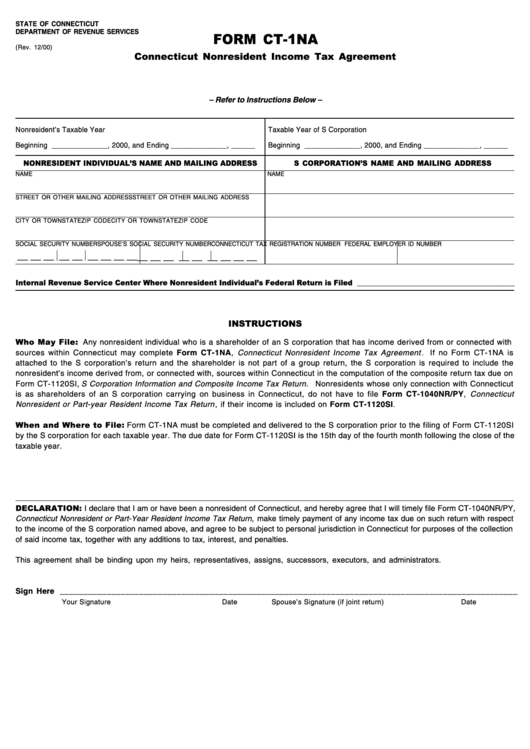

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

FORM CT-1NA

(Rev. 12/00)

Connecticut Nonresident Income Tax Agreement

– Refer to Instructions Below –

Nonresident’s Taxable Year

Taxable Year of S Corporation

Beginning ______________, 2000, and Ending ______________, ______

Beginning ______________, 2000, and Ending ______________, ______

NONRESIDENT INDIVIDUAL’S NAME AND MAILING ADDRESS

S CORPORATION’S NAME AND MAILING ADDRESS

NAME

NAME

STREET OR OTHER MAILING ADDRESS

STREET OR OTHER MAILING ADDRESS

CITY OR TOWN

STATE

ZIP CODE

CITY OR TOWN

STATE

ZIP CODE

SOCIAL SECURITY NUMBER

SPOUSE’S SOCIAL SECURITY NUMBER

CONNECTICUT TAX REGISTRATION NUMBER FEDERAL EMPLOYER ID NUMBER

__ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __

Internal Revenue Service Center Where Nonresident Individual’s Federal Return is Filed ____________________________________________

INSTRUCTIONS

Who May File: Any nonresident individual who is a shareholder of an S corporation that has income derived from or connected with

sources within Connecticut may complete Form CT-1NA, Connecticut Nonresident Income Tax Agreement . If no Form CT-1NA is

attached to the S corporation’s return and the shareholder is not part of a group return, the S corporation is required to include the

nonresident’s income derived from, or connected with, sources within Connecticut in the computation of the composite return tax due on

Form CT-1120SI, S Corporation Information and Composite Income Tax Return. Nonresidents whose only connection with Connecticut

is as shareholders of an S corporation carrying on business in Connecticut, do not have to file Form CT-1040NR/PY, Connecticut

Nonresident or Part-year Resident Income Tax Return , if their income is included on Form CT-1120SI.

When and Where to File: Form CT-1NA must be completed and delivered to the S corporation prior to the filing of Form CT-1120SI

by the S corporation for each taxable year. The due date for Form CT-1120SI is the 15th day of the fourth month following the close of the

taxable year.

DECLARATION: I declare that I am or have been a nonresident of Connecticut, and hereby agree that I will timely file Form CT-1040NR/PY,

Connecticut Nonresident or Part-Year Resident Income Tax Return, make timely payment of any income tax due on such return with respect

to the income of the S corporation named above, and agree to be subject to personal jurisdiction in Connecticut for purposes of the collection

of said income tax, together with any additions to tax, interest, and penalties.

This agreement shall be binding upon my heirs, representatives, assigns, successors, executors, and administrators.

Sign Here __________________________________________________________________________________________________

Your Signature

Date

Spouse’s Signature (if joint return)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1