Form Ri-100 - Estate Tax Return

Download a blank fillable Form Ri-100 - Estate Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Ri-100 - Estate Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

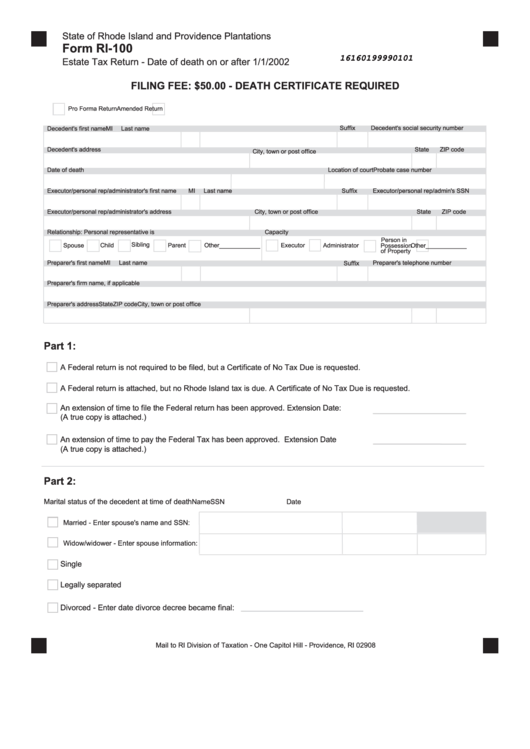

State of Rhode Island and Providence Plantations

Form RI-100

16160199990101

Estate Tax Return - Date of death on or after 1/1/2002

FILING FEE: $50.00 - DEATH CERTIFICATE REQUIRED

Pro Forma Return

Amended Return

Suffix

Decedent's social security number

Decedent's first name

MI

Last name

Decedent's address

State

ZIP code

City, town or post office

Date of death

Probate case number

Location of court

Executor/personal rep/administrator's first name

MI

Last name

Suffix

Executor/personal rep/admin's SSN

Executor/personal rep/administrator's address

City, town or post office

State

ZIP code

Relationship: Personal representative is

Capacity

Person in

Sibling

Spouse

Child

Parent

Executor

Administrator

Possession

Other____________

Other____________

of Property

Preparer's first name

MI

Last name

Preparer's telephone number

Suffix

Preparer's firm name, if applicable

Preparer's address

City, town or post office

State

ZIP code

Part 1:

A Federal return is not required to be filed, but a Certificate of No Tax Due is requested.

A Federal return is attached, but no Rhode Island tax is due. A Certificate of No Tax Due is requested.

An extension of time to file the Federal return has been approved.

Extension Date:

(A true copy is attached.)

An extension of time to pay the Federal Tax has been approved.

Extension Date

(A true copy is attached.)

Part 2:

Marital status of the decedent at time of death

Name

SSN

Date

Married - Enter spouse's name and SSN:

Widow/widower - Enter spouse information:

Single

Legally separated

Divorced - Enter date divorce decree became final:

Mail to RI Division of Taxation - One Capitol Hill - Providence, RI 02908

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2