Form Ct-1040ez - Connecticut Resident Ez Income Tax Return - 2002 Page 2

ADVERTISEMENT

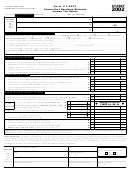

SCHEDULE 1 EZ - CREDIT FOR PROPERTY TAXES PAID ON YOUR PRIMARY RESIDENCE AND/OR MOTOR VEHICLE

Failure to complete this schedule could result in the disallowance of this credit.

COLUMN A

COLUMN B

COLUMN C

COLUMN D

COLUMN E

QUALIFYING

Name of

Description of Property

Date(s) Paid

List or Bill

PROPERTY

Connecticut Tax

If primary residence, enter street address

Number

(See instructions,

Amount Paid

Town or District

If motor vehicle, enter year, make, and model

Page 11)

(if available)

Primary

18

Residence

Auto 1

19

Married Filing

20

Jointly Only - Auto 2

21. TOTAL PROPERTY TAX PAID (Add all amounts for Column E)

21

22. MAXIMUM PROPERTY TAX CREDIT ALLOWED

22

500 00

23. Enter the Lesser of Line 21 or Line 22 (If $100 or less, enter this amount on Line 25. If greater than $100, go to Line 24.)

23

24. Limitation - Enter the result from the Property Tax Credit Limitation Worksheet . (See note below)

24

25. Subtract Line 24 from Line 23. Enter here and on Line 5.

25

Note: Enter “0” on Line 24 and do not complete the Property Tax Credit Limitation Worksheet if your filing status is:

Single and your Connecticut AGI is $54,500 or less;

Married Filing Jointly and your Connecticut AGI is $100,500 or less;

Married Filing Separately and your Connecticut AGI is $50,250 or less;

Head of Household and your Connecticut AGI is $78,500 or less.

Otherwise, complete the Property Tax Credit Limitation Worksheet on the inside back cover of this booklet and enter the amount from the worksheet on

Line 24. DRS will help you calculate your property tax credit by using the Property Tax Credit Calculator on the DRS Web site at:

SCHEDULE 2 EZ - INDIVIDUAL USE TAX

Complete this schedule if you have a Connecticut individual use tax liability. You owe use tax if you purchased taxable goods or services during the

taxable year and did not pay Connecticut sales tax on the purchases. Individual items with the purchase price of $300 or more must be listed separately

below. Although you do not need to list separately any individual item with a purchase price of less than $300, such items are subject to tax and the total

of the purchase prices of these items should be reported on Line A. Multiply the sales and use tax rate by the purchase price of the item and enter the

result in Column E.

COLUMN D

COLUMN E

COLUMN F

COLUMN G

COLUMN A

COLUMN B

COLUMN C

Balance Due

Tax, if any,

Date of

Description of

Retailer or

Purchase

CT Tax Due

(Col. E – Col. F but

Paid to Another

Price

(.06 X Column D)

Purchase

Goods or Services

Service Provider

Jurisdiction

not less than zero)

A

A. TOTAL OF INDIVIDUAL PURCHASES UNDER $300 NOT LISTED ABOVE

26. Individual Use Tax (Add all amounts for Column G) Enter here and on Line 7.

26

See Informational Publication 2002(21), Q & A on the Connecticut Individual Use Tax, for more information.

SCHEDULE 3 EZ – CONTRIBUTIONS OF REFUND TO DESIGNATED CHARITIES (See instructions, Page 12)

AIDS Research

__ $2

__ $5

__ $15

other ___ .00

Breast Cancer Research

___ $2

__ $5

_ $15

other ___ .00

Organ Transplant

__ $2

__ $5

__ $15

other ___ .00

Safety Net Services

___ $2

__ $5

_ $15

other ___ .00

Endangered Species/Wildlife

__ $2

__ $5

__ $15

other ___ .00

00

27. TOTAL CONTRIBUTIONS. Enter here and on Line 15.

27

Do you authorize DRS to contact another person about this return? (See Page 10)

Yes. Complete the following.

No

Third Party

Designee’s Name

Telephone Number

Personal Identification

Designee

(

)

Number (PIN)

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief,

it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or imprisonment for not

more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Sign Here

Your Signature

Date

Daytime Telephone Number

(

)

Keep a

copy for

Spouse’s Signature (if joint return)

Date

Daytime Telephone Number

(

)

your

records.

Paid Preparer’s Signature

Date

Telephone Number

Preparer’s SSN or PTIN

(

)

Firm’s Name, Address, and ZIP Code

FEIN

Form CT-1040EZ Back (Rev. 12/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2