Form 1120es-Me - Estimated Tax Payment Voucher For Corporations, Form 1120ext-Me - Extension Payment Voucher For Maine Corporate Income Tax - 2001

ADVERTISEMENT

*020020000*

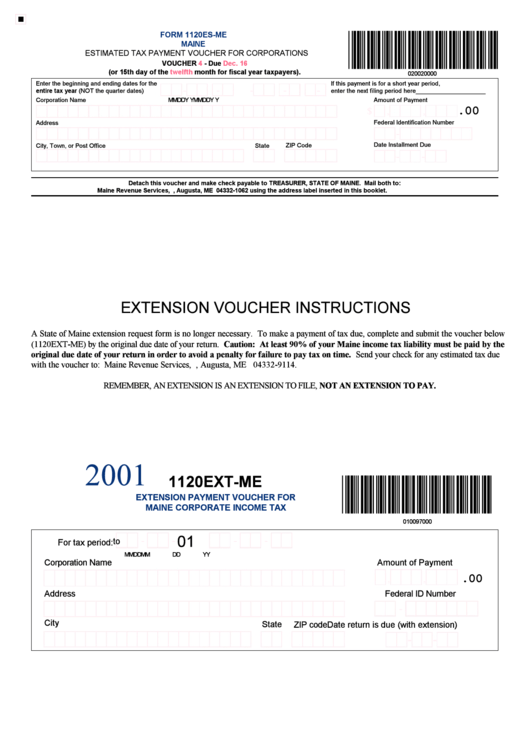

FORM 1120ES-ME

MAINE

ESTIMATED TAX PAYMENT VOUCHER FOR CORPORATIONS

VOUCHER

4

- Due

Dec. 16

(or 15th day of the

twelfth

month for fiscal year taxpayers).

020020000

Enter the beginning and ending dates for the

If this payment is for a short year period,

-

-

-

-

-

entire tax year (NOT the quarter dates)

enter the next filing period here _____________________

Corporation Name

MM

DD

Y Y

MM

DD

Y Y

Amount of Payment

$

,

,

.00

Federal Identification Number

Address

-

Date Installment Due

City, Town, or Post Office

ZIP Code

State

-

-

Detach this voucher and make check payable to TREASURER, STATE OF MAINE. Mail both to:

Maine Revenue Services, P.O. Box 1062, Augusta, ME 04332-1062 using the address label inserted in this booklet.

EXTENSION VOUCHER INSTRUCTIONS

A State of Maine extension request form is no longer necessary. To make a payment of tax due, complete and submit the voucher below

(1120EXT-ME) by the original due date of your return. Caution: At least 90% of your Maine income tax liability must be paid by the

original due date of your return in order to avoid a penalty for failure to pay tax on time. Send your check for any estimated tax due

with the voucher to: Maine Revenue Services, P.O. Box 9114, Augusta, ME 04332-9114.

REMEMBER, AN EXTENSION IS AN EXTENSION TO FILE, NOT AN EXTENSION TO PAY.

2001

*010097000*

1120EXT-ME

EXTENSION PAYMENT VOUCHER FOR

MAINE CORPORATE INCOME TAX

010097000

-

-

-

-

01

to

For tax period:

MM

DD

MM

DD

Y Y

Corporation Name

Amount of Payment

,

,

.00

Address

Federal ID Number

-

City

State

ZIP code

Date return is due (with extension)

-

-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1