Instructions For Form 8801 - Credit For Prior Year Minimum Tax-Individuals, Estates-Trusts - 2012

ADVERTISEMENT

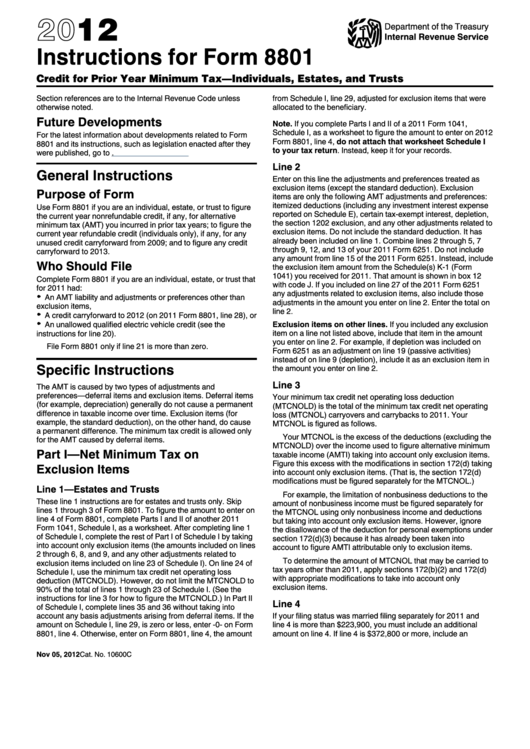

2012

Department of the Treasury

Internal Revenue Service

Instructions for Form 8801

Credit for Prior Year Minimum Tax—Individuals, Estates, and Trusts

Section references are to the Internal Revenue Code unless

from Schedule I, line 29, adjusted for exclusion items that were

otherwise noted.

allocated to the beneficiary.

Future Developments

Note. If you complete Parts I and II of a 2011 Form 1041,

Schedule I, as a worksheet to figure the amount to enter on 2012

For the latest information about developments related to Form

Form 8801, line 4, do not attach that worksheet Schedule I

8801 and its instructions, such as legislation enacted after they

to your tax return. Instead, keep it for your records.

were published, go to

Line 2

General Instructions

Enter on this line the adjustments and preferences treated as

exclusion items (except the standard deduction). Exclusion

Purpose of Form

items are only the following AMT adjustments and preferences:

itemized deductions (including any investment interest expense

Use Form 8801 if you are an individual, estate, or trust to figure

reported on Schedule E), certain tax-exempt interest, depletion,

the current year nonrefundable credit, if any, for alternative

the section 1202 exclusion, and any other adjustments related to

minimum tax (AMT) you incurred in prior tax years; to figure the

exclusion items. Do not include the standard deduction. It has

current year refundable credit (individuals only), if any, for any

already been included on line 1. Combine lines 2 through 5, 7

unused credit carryforward from 2009; and to figure any credit

through 9, 12, and 13 of your 2011 Form 6251. Do not include

carryforward to 2013.

any amount from line 15 of the 2011 Form 6251. Instead, include

Who Should File

the exclusion item amount from the Schedule(s) K-1 (Form

1041) you received for 2011. That amount is shown in box 12

Complete Form 8801 if you are an individual, estate, or trust that

with code J. If you included on line 27 of the 2011 Form 6251

for 2011 had:

any adjustments related to exclusion items, also include those

An AMT liability and adjustments or preferences other than

adjustments in the amount you enter on line 2. Enter the total on

exclusion items,

line 2.

A credit carryforward to 2012 (on 2011 Form 8801, line 28), or

Exclusion items on other lines. If you included any exclusion

An unallowed qualified electric vehicle credit (see the

instructions for line 20).

item on a line not listed above, include that item in the amount

you enter on line 2. For example, if depletion was included on

File Form 8801 only if line 21 is more than zero.

Form 6251 as an adjustment on line 19 (passive activities)

instead of on line 9 (depletion), include it as an exclusion item in

Specific Instructions

the amount you enter on line 2.

Line 3

The AMT is caused by two types of adjustments and

preferences—deferral items and exclusion items. Deferral items

Your minimum tax credit net operating loss deduction

(for example, depreciation) generally do not cause a permanent

(MTCNOLD) is the total of the minimum tax credit net operating

difference in taxable income over time. Exclusion items (for

loss (MTCNOL) carryovers and carrybacks to 2011. Your

example, the standard deduction), on the other hand, do cause

MTCNOL is figured as follows.

a permanent difference. The minimum tax credit is allowed only

Your MTCNOL is the excess of the deductions (excluding the

for the AMT caused by deferral items.

MTCNOLD) over the income used to figure alternative minimum

Part I—Net Minimum Tax on

taxable income (AMTI) taking into account only exclusion items.

Figure this excess with the modifications in section 172(d) taking

Exclusion Items

into account only exclusion items. (That is, the section 172(d)

modifications must be figured separately for the MTCNOL.)

Line 1—Estates and Trusts

For example, the limitation of nonbusiness deductions to the

These line 1 instructions are for estates and trusts only. Skip

amount of nonbusiness income must be figured separately for

lines 1 through 3 of Form 8801. To figure the amount to enter on

the MTCNOL using only nonbusiness income and deductions

line 4 of Form 8801, complete Parts I and II of another 2011

but taking into account only exclusion items. However, ignore

Form 1041, Schedule I, as a worksheet. After completing line 1

the disallowance of the deduction for personal exemptions under

of Schedule I, complete the rest of Part I of Schedule I by taking

section 172(d)(3) because it has already been taken into

into account only exclusion items (the amounts included on lines

account to figure AMTI attributable only to exclusion items.

2 through 6, 8, and 9, and any other adjustments related to

To determine the amount of MTCNOL that may be carried to

exclusion items included on line 23 of Schedule I). On line 24 of

tax years other than 2011, apply sections 172(b)(2) and 172(d)

Schedule I, use the minimum tax credit net operating loss

with appropriate modifications to take into account only

deduction (MTCNOLD). However, do not limit the MTCNOLD to

exclusion items.

90% of the total of lines 1 through 23 of Schedule I. (See the

instructions for line 3 for how to figure the MTCNOLD.) In Part II

Line 4

of Schedule I, complete lines 35 and 36 without taking into

account any basis adjustments arising from deferral items. If the

If your filing status was married filing separately for 2011 and

amount on Schedule I, line 29, is zero or less, enter -0- on Form

line 4 is more than $223,900, you must include an additional

8801, line 4. Otherwise, enter on Form 8801, line 4, the amount

amount on line 4. If line 4 is $372,800 or more, include an

Nov 05, 2012

Cat. No. 10600C

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5